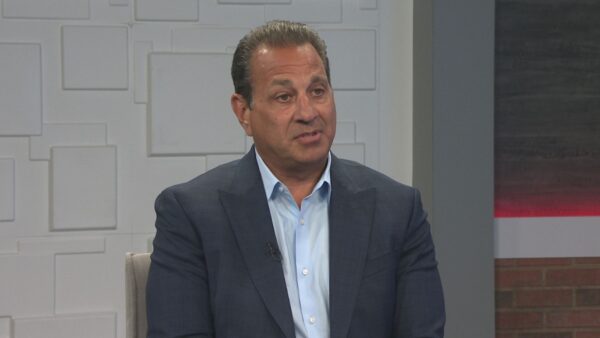

In 2014, identification fraud cost the government $6 billion when people filed taxes using someone else’s name and social security number. Arizona State University professor Shawn Novak of the School of Public Affairs was a senior tax policy analyst for the US Senate Finance Committee, and will tell us more about tax fraud and efforts to prevent it.

Ted Simons: Tax filing season is here, which means that it's the time of year when tax filing fraud through identity theft becomes a point of concern. Here now to talk about this avenue of tax fraud is Shawn Novak, of ASU's School of Public Affairs and a former Senior Tax Policy Analyst for the U.S. Senate Finance Committee. Welcome to Arizona Horizon.

Shawn Novak: Thank you.

Ted Simons: Good to have you here. Fraudulent tax filing. What exactly are we talking about here?

Shawn Novak: What's happening here is that people use stolen identity information, and they use that to file a tax, a fraudulent tax return, and create and steal a refund by doing that. And, and if you look at the way that our tax system works, about 150 million tax returns are filed by households each year. 110 million of those households get refunds. The average refund is about 3,000. So, in this tax refund season, the government is shooting money out of a fire hose $300 billion, you know, out of a 90-day window here, so an enormous number of refunds going out, and the IRS has to you know, look at these return filings and figure out if they are legitimate or not. It's really difficult.

Ted Simons: I am seeing anywhere between 5 and 6 billion in fraudulent payments?

Shawn Novak: That's right.

Ted Simons: That's a lot of money.

Shawn Novak: That is. That's a huge amount of money each by D.C. standards.

Ted Simons: And is the increase in online filing, is that playing a factor here?

Shawn Novak: That has certainly made it easier for the thieves to do this. But, I would say the real underlying problem is the fact that there is so much stolen identity information out there, that the thieves, you know, they have got the adequate data base of information you know, to file the return, to begin with.

Ted Simons: So, who are these thieves, and how sophisticated -- are they gangs or just individual or what's going on?

Shawn Novak: Really, this crime was invented in Florida, and about eight, nine years ago now, and that's where really, it first popped up on the radar. And a lot of it was associated with data breaches at hospitals, and doctors' offices, and nursing homes, and that sort of thing. And the thieves were, you know, early on, you did not have to be very sophisticate to be able to get away with this because the IRS systems just weren't geared up to look for this. And they are doing a much, much better job now, of screening returns, identifying fraudulent attempts, and they are probably stopping five out of six attempts now, but the problem is, there is 6, 7 million attempts a year, so a million of them are still getting through. That's how we're losing 6 billion a year.

Ted Simons: And some of those are, no doubt, automated, and would, I would imagine? I would imagine thieves and criminals must be offshore.

Shawn Novak: Yeah, there is a lot of evidence of that, and they are very sophisticated. They are able to use, and I don't understand how they do it, but they can make it appear as though the return is being filed from, you know, Omaha or Phoenix or wherever. Even though it's coming from, you know, Czechoslovakia.

Ted Simons: What can be done to improve the effectiveness? What can be done to improve this situation?

Shawn Novak: Well, actually, in the recent tax act, tax and budget act, that was passed at the end of the year, a couple of important provisions in there. The first one will take effect in the next tax filing season. The W-2 information that you get from your employer, the law has always been that it's reported to employees by the end of January. And now, that same information will be reported to the government, also, by the end of January. So, really, up until now, the system that the Government was using was they are processing tax returns, and paying out refunds before they really even have the information in their data systems to adequately validate the return.

Ted Simons: Does that mean delays and some refunds, doesn't it?

Shawn Novak: It probably does. But, not in a big way, and then, in tandem with that, again, beginning next year, the government is going to delay the refunds until after February 15th, and in the case where the tax return has what's called a refundable tax credit. The best example of a refundable tax credit would be the earned income credit. So, that's the case where somebody gets a tax refund that vastly exceeds any amount of income tax that was withheld from the tax return.

Ted Simons: I had read that President Obama wants 19 billion for more secured government technology, certainly would help, would it not?

Shawn Novak: It would. It would. The IRS really suffers from having antiquated technology. Really, if you look at their systems that they are using, a lot of them are really grounded in the era of paper returns, and they have not had adequate resources to upgrade their information technology at the rate that it needs to be upgraded.

Ted Simons: With that in mind, critics will say the government is far behind the private sector when it comes to this kind of technology, and this kind of crime fighting. Is that a valid position there?

Shawn Novak: That is valid. Really, the IRS is doing a lot of good things right now. Trying to learn from the banking and the credit card industry, hiring a lot of expertise from those industries to try to use some of their business practices to catch more of this type of fraud.

Ted Simons: Real quickly, if you are a victim of this kind of fraud, what happens?

Shawn Novak: Well, it's a long labor intensive process. So, essentially, what happens is, you have the burden of proving to the IRS that the first return that was filed was -- is fraudulent. You can do it but it's a process that takes a lot of documentation on our part, and a lot of time on the phone and a lot of that time is going to be on hold. It's a very frustrating experience for people. And another point that's worth making is a lot of the victims are relatively low income people. These are people working 50, 60 hours a week and they don't have time to spend five or six hours a week on the phone, you know, trying to get somebody at the IRS to help them to straighten this out.

Ted Simons: All right.

Shawn Novak: So it's taking victims six months to a year in a lot of cases to straighten it out.

Ted Simons: Interesting. And good information. Good to have you here, and thanks for joining us.

Shawn Novak: Enjoyed it.

Ted Simons: And Wednesday on Arizona Horizon, we'll find out what happened to the El Niño powered rain that we were supposed to get this winter, and State Senate President Andy Biggs will join us in the studio. That's at 5:30 and 10:00 on the next Arizona Horizon. That is it for now. I'm Ted Simons. Thank you very much for joining us. You have a great evening.

Video: Arizona Horizon is made possible by contributions from the friends of Arizona PBS, members of your PBS station. Thank you.

Shawn Novak: Arizona State University professor of the School of Public Affairs