Although the nation’s unemployment rate fell in August, fewer jobs than expected were added, with the jobless rate dropping due to fewer people looking for work. Economist Jim Rounds of Elliott D. Pollack and Company will discuss the employment situation.

Ted Simons: The nation's unemployment rate fell in August but the job growth rate was down, too which suggests that the unemployment rate dropped due to fewer people looking for work. Here to help us make sense of all this is Jim Rounds of the Elliott D. Pollack & Company. Good to see you.

Jim Rounds: Good to see you.

Ted Simons: August jobless rate down. Good, right?

Jim Rounds: We're seeing the trend of the unemployment rate going down but it's due to a number of things. What you mentioned, there are some people leaving the workforce, they are not looking for work anymore. Additional people are moving up in terms of having a lower paid job after the downturn. They are getting into a more normal job. The unemployment number doesn't tell you a whole lot. The one I like to look at at the U.S. level is how many jobs have been created. Normally we'd like to see about 200,000 on a month over month basis. 300,000 though, would be a recovery. 142 was a little low but it could be an anomaly, it could be back up within a few months.

Ted Simons: Speaking of anomaly, eight months or so, it's been over 200,000 for quite a string now.

Jim Rounds: Yeah, for six months straight. Sometimes this data gets revised. Don't rely too much on just one data point. I still think we're moving more towards 200 to 250,000 on a month over month basis and maybe 300,000 by next year.

Ted Simons: On the months when it was over 200,000, can you see anything that may have happened then that may not have happened in August?

Jim Rounds: It's hard to tell. Data gets revised, you go through some seasonal effects. We hear about a report but has to do with going into the summer months and the education effect. They try to make an adjustment for the seasonal effects but it's not always perfect. Even in boom times we still see the series kind of jagged. If you look at the longer term trend we're still improving, just not at the rate that we were hoping.

Ted Simons: At a better rate than we thought maybe year ago considering those eight straight months of 200,000?

Jim Rounds: A year ago people talked about whether or not we would get another downturn. Everybody got spooked when we went through the first quarter of the GDP decline. We're entering a period when we understand the economic data. When we went into the downturn we ended up seeing that half the data will make sense, the other half you can't quite figure out but you know something's up. All the data it's so relatively weak and improving, but it's all consistent. We feel comfortable with the long term forecasts that we're getting better but we'd like to see it improve a little more than it has been.

Ted Simons: When the recession hit, just like when the flooding hits, you learn something new every time. When the recession hit did we learn something new about the numbers, about the economy?

Jim Rounds: Yes, especially Arizona. We learned we're not always in a situation where we outperform the U.S. Every prior economic downturn and expansion we've done better than the U.S. This has been the first time since around the 1940s that we were more cyclical than the U.S. Typically we do better. It's because population flow stopped. If it really impacts people's ability to move, all bets are off. We're talking about some of those things that make the economy tick, like transportation infrastructure, education, things like that.

Ted Simons: And again, the labor department is saying that layoffs really aren't a problem, manufacturing, construction, auto sales, those things seem to be okay. Recent data suggests it's still relatively healthy out there.

Jim Rounds: Yeah. We're seeing -- when you go into the recovery, you tend to see lower paying jobs come first. Then after a while you see the higher paying jobs come. There were reports that the higher paying jobs were outpacing the lower paying jobs. That's now how it economy works so I think there were some flaws in those studies. We're not seeing that as much in Arizona yet. We still need to see some people move here, some additional improvement in construction employment, and even some of the lower paying ones first. But it'll come. Instead of full recovery in 2015 like we were forecasting two or three years ago, it's looking like 2016 now.

Ted Simons: It might be 2016 perhaps but at least you're angling in the right direction. But as opposed to a year ago when it looks like we were going in the wrong direction.

Jim Rounds: We try to remind people we're five years into this economic recovery also. There's nothing that we're building up excesses and the state is going to fall off a cliff. The recovery is getting long in the tooth. We're probably not going to see a downturn right around the corner. Be prepared for the fact that things might not be normal in terms of the Arizona recovery, we might not have that boom that we're used to, but expect next year to be better than last year and the next year better than that. Be very careful going past two or three years.

Ted Simons: And be careful if you're counting on customers buying things because with wages stagnant, the lower paying jobs seem to be the ones coming back first. If that's the case, folks won't be buying as much as they usually are.

Jim Rounds: Spot on. Consumers aren't buying as much and businesses aren't investing as much. If you look at numbers like we do, it looks like things are barely improving relatively flat but what's really hard to predict if when things suddenly turn up because you can't just draw a line between two data points and get a ruler and do your forecast. We try to put some thought into it. It's hard to hit those inflection points when we ramp up. I just don't think it's going to be ramping up as solidly as we saw last time.

Ted Simons: Last question, this is rhetorical but I'll throw it out anyway. As an economist would you rather see the ramp like this? Or do you want to see it go like this tomorrow?

Jim Rounds: We don't want to see a bubble. In housing we don't want to see a bubble in the stock market. If things are only going naturally moderately improve, I'd rather they just improve in that way rather than create another bubble. People stop spending, businesses stop investing and it's really going impact the economy.

Ted Simons: Moderation in all things when it comes to the economy?

Jim Rounds: That's right.

Ted Simons: Jim, good to see you.

Jim Rounds: Good to see you.

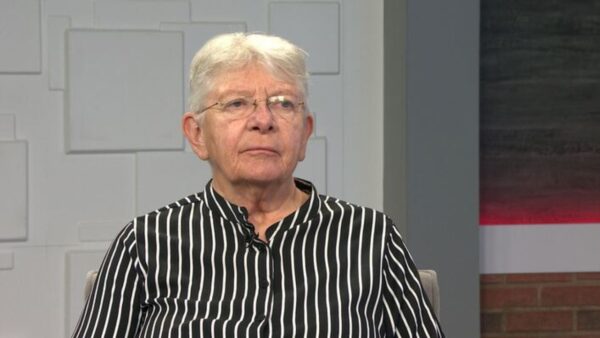

Jim Rounds:Economist, Elliott D. Pollack and Company;