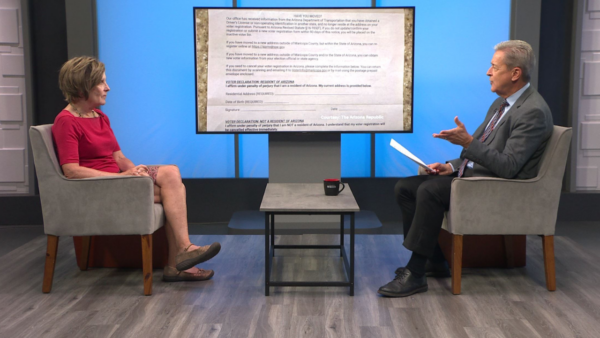

The past year has been brutal for the economy both nationally and in Arizona. Arizona State University economists Jay Butler, Tony Sanders and Dennis Hoffman join HORIZON host Ted Simons to discuss how bad it's been and to forecast the upcoming year.

Ted Simons:

Tonight on Horizon, the bad economy has been the story of year. Tonight we gather three economists to take a look at the economy in 2008 and tell us where we are headed in 2009. That's next on "Horizon."

Horizon is made possible by the friends of Eight. Members of your Arizona PBS station. thank you.

Ted Simons:

Good evening and welcome to Horizon. I'm Ted Simons. It's being called the biggest economic downturn since World War II. Banks have failed, the stock market is in the tank and unemployment is steadily increasing. And it doesn't look like things will improve anytime soon. I'll talk to three ASU economists about our state and national economies. But first, Mike Sauceda recently attended an economic forecast luncheon where three other economists gave their take on the situation.

Mike Sauceda:

This is probably as good of an economic indicator as any - a room that's usually filled with business people who pay high dollar for an economic forecast that's only half full this year at the annual J.P. Morgan Chase and the W.P. Carey School of Business Economic Forecast luncheon. Last year, none of the economists thought we were in a recession at the time even though we know it had already started. Joel Naroff, one of the leading forecasters in the nation, was not at last year's event. He said some of the economists didn't believe that the numbers coming out were really that bad.

Joel Naroff:

I think there was a lack of recognition, if not acceptance, of the extensive nature of the foreclosures. Even last spring when I was told we could be looking at losses to banks between $250 billion and $500 billion from this, it was hard for me to truly get my hands around that. And I think while there were these forecasts out there that it could create that, we hadn't seen anything like that and it was hard to put it into a model and say all of this indeed will occur. It was a failure to accept what the numbers were telling us.

Mike Sauceda:

Naroff talked about just how bad the economy is right now.

Joel Naroff:

The consumer now is concerned, depressed and essentially not spending. We've lost jobs every month this year. the incomes have gone down. There's been very little spending along those lines. Businesses have assumed what I call the turtle position, where they've essentially pulled their legs and head and tails into their shells and are trying to ride this out rather than be aggressive.

Mike Sauceda:

At a press conference held before the luncheon, Naroff says a scenario where a depression is possible is realistic.

Joel Naroff:

We don't know how deep and how long this recession will be. My forecast is my forecast. Others have it lasting a lot longer and taking a lot longer to get out of it and being a lot steeper than I do. And those are realistic forecasts as I said, these are cases where I can construct the depression scenario and it's realistic.

Mike Sauceda:

Despite such a dire scenario, Naroff sees the economy starting to rebound in the middle of 2009. He said the mood of consumers will play a big role.

Joel Naroff:

Finally, the most important point I am going to make is that a large part of what we going through is psychological. We see confidence measures of households and businesses that are at all-time lows and that's been going on for a while, even when unemployment rates were relatively low and growth was not that bad. We seemed to have moved from a period of irrational exuberance to irrational despondence.

Mike Sauceda:

ASU economist Lee McPheters talked to reporters about Arizona's economy.

Lee McPheters:

I think we're all aware the economy contracted throughout 2008. The bottom line forecast is that 2009 is going to bring more of the same. The optimistic forecasts say that there will be no growth at all. And the pessimists have a lot of minus signs in front of job growth, retail sales, housing starts and other indicators.

Mike Sauceda:

McPheters says that Arizona's economy, because of its diversity, is tied more closely than ever to the fortunes or misfortunes of the national economy. He said the latest figures show Arizona has lost about 70,000 jobs, a big turn around for the state.

Lee McPheters:

Two years ago, 2006, Arizona was the number one state in the country for job creation. Here we are two years later, we are number 49. If not for Rhode Island, we would be the worst in the country.

Mike Sauceda:

Of course, housing is what's driving the economy in its downward spiral. Economist Elliott Pollack says the Phoenix area has a glut of up to 50,000 homes. Other numbers regarding the housing market are just as dismal.

Elliott Pollack:

In the last year, 50% of homes sold in greater Phoenix were sold at a loss, 38% were foreclosures and 42% had negative equity. The latest data shows that 51% of all the resells in Maricopa County were foreclosures, 71% of all the resells in Pinal County were foreclosures. Old guys like me, we're used to 30-year fixed rate mortgages and they account for 57% of the loans in Arizona and 14% of the foreclosures. The guys who work for me are used to basically subprime ARMs and they account for about 10% of the loans in Arizona but 53% of the foreclosures.

Mike Sauceda:

Pollack says that other real estate sectors are suffering as well and he doesn't expect the market to be back to normal until 2013. But on a positive note, there is one silver lining in all the bad news about real estate.

Elliott Pollack:

Affordability, as Lee said is the only good news. Affordability fell like a ton of bricks. The good news is that affordability is now better than it has been than any time in our history. In fact, it's much better than before this whole thing started, with almost 71%-72% of the people being able to afford the median priced home. Problem is nobody wants to take a bite of the apple right now and certainly most shoppers are looking for foreclosed properties.

Ted Simons :

Here now to talk about the economy is Jay Butler a real estate professor at Arizona State University's Morrison School of Management and Agribusiness at the Polytechnic campus. Also here is finance and real estate Professor Anthony Sanders, and economics professor Dennis Hoffman, both from ASU's W.P. Carey School of Business. Thank you for joining us on Horizon. Dennis, how bad is it?

Dennis:

Ted, it's nationally bad. In Arizona, beyond bad. Colleague McPheters just talked about the job losses this year in Arizona. We're seeing massive job losses now nationwide. This is every bit -- looks every bit like the worst recession in the post-war period. At least on some measures. Now, '75 was no picnic. '82 was no picnic and we have a ways to go to get there. But the signs are just simply not good at all.

Ted Simons :

Are the signs -- is there a "d" in any word you see on the signposts ahead?

Anthony Sanders:

That's very possible. We're having horrible problems in the housing market. The foreclosure wave is still coming. We have all these [inaudible] liar loans. We have four years of them to clear out of the market and a lot haven't begun resetting yet. Once that hits that's going to be like that rogue wave of the Pacific that's going to crush the west coast. Regionally we're bad but the rest of the United States isn't in such bad shape. And wait until the sales figures come in from Christmas. We are going to see some real pain.

Jay Butler:

We can sit around and talk about a recession in the general sense and if you've lost your job and there isn't much hope of you get one for a period of time and people are calling and wanting to foreclose on your home and you can't go through mediation because you have no income, you're in a depression, and we're gaining more and more of these kinds people. And the big waves of foreclosures in the coming months are going to be really people losing their jobs. Sort of the traditional. We're running 40%-45% of our resale activity as foreclosures. Historically, it is 3%. This is just the way of the market. The only slightly good news is that the homes the lenders foreclosed on are now being sold back into the market to investors and others but at a 25%-30% markdown.

Ted Simons :

In general terms, how did we get here? We can talk about who to blame. I've heard everyone from Jimmy Carter to Allen Greenspan from Barney Frank to George Bush. How did we get here? What happened?

Jay Butler:

We're all to blame. I mean in the sense we all believed in everything was being good-- we went throughout the dot-com things. Things were good. Things were going good. Nobody believed home prices were going to go up forever. It was going to be another year or two. We all bought into it.

Anthony Sanders:

I would say consumers, government, state and local, and everybody around the world. Just not just the U.S. It was borrow, borrow, spend, spend, spend. Everyone did it. We were watching this nightmare unfold. And we finally hit what we'll call the debt overhang. We finally hit the point where we have so much debt outstanding it had to crash and when it crashes, it crashed hard. So it's consumers -- I agree with Jay on that. It's consumers, but our governments really increased social spending, which is programs, sound good but you have to fund them. And they weren't funding them. They were underfunding them and now they have no way to pay for them.

Ted Simons :

The national economy in general, Arizona in particular, consumer spending, we're hearing that more and more. Were we all just too dependent on consumer spending?

Dennis Hoffman:

Ted, look let's dial it back 12 months ago this time. I know of nobody that came close to forecasting -- from 12 months ago where we are today. And the reason I think is now it looks almost foolish to some degree, but we had an abundance of business confidence, investor confidence and consumer confidence and it fueled buying, it fueled investing, business expansion, equity plays. Equity markets over the last -- I don't know exactly when it happened, Tony, but over the last 20 to 30 years, evolved from this old kind of traditional notion that you invested for the long run. You reap long-run returns, that created a pool of capital for business. And it kind of transformed, in recent years into the fast trade-- what's it doing quarterly. We should be measuring returns over decades and lifetimes, not months and quarters.

Ted Simons :

But how do you do that? How do you tell people that those double digit returns they're not real. You better watch out. We had cries in the wilderness, but no one paying attention.

Anthony Sanders:

We had a series of events that led to systemic failure. We had Madoff. The recent big blowup we had in securities. How could that many investors, people who have been sophisticated investment managers, be lured in by what he said he was going to earn each year? It never made sense and how -- it became sort of irrational exuberance in terms of how much returns they thought they could get or yields they could get on asset-backed securities they were buying in the market. They were buying subprime paper that was going historically at 1/2% and they were getting yields of 15% and saying, oh, my gosh, this is great and I was saying, risk return. We've got to cut the risk back in the risk return equation and diversify and we all forgot about diversification.

Ted Simons :

How do you do that, Jay? How do you tell people you've got to careful, that the house you're sitting on while it may be worth "x" right now, it's not real. They're just numbers.

Dennis Hoffman

We told them in '05-'06, Jay, what did they say?

Jay Butler:

They didn't believe you. Because other people said, you had all the people ... you had infomercials. One of the problems we had, one of the first things that Bush approached in term one was Social Security was in trouble and told everybody you can't count on it in 20 years. And then we had United Airlines dumping their pensions in and showing people their private pension may not be any good. So in the sense, the only people you could count on was yourself. The stock market was dying because of the dot-com situation. The one thing that was doing well was housing. So we had the infomercials. We had the books. We had all this-- the charts showing straight up so people began to buy. People should never have bought. They didn't know how to manage a home. They didn't know how to do anything. They were overpaying. They watched the flip shows. One of the things to do was watch the flip show that was done 2004 and 2005 - they make a lot of money. Done in 2007 - it's still sitting on the market. They watched this stuff and believed it, because in a sense they were seeing it happen. And the alternatives weren't that good. And everybody got caught up in it and then they paid a horrible price.

Ted Simons :

In the grand scheme of things, the psychological aspect of this, does this mean that people do go back and look beyond the short-term gain or will there always be a bubble? Will we always have "tulips?"

Anthony Sanders:

Let me say it this way. Our government who was supposed to be our friend and the Federal Reserve, etc. who were supposed to monitoring this. In 2003, I wrote an article and I said our banks are so much off balance sheet financing. Europe is even worse. I said if anything turns down in the housing market or anything else, we going to have an explosion. And generally the reaction was that's five years in the future. Let's not worry about it now. It's myopia. Wall Street is paid on a bonus system. It's very much short term. People can't forecast out beyond a year. People never did really consider that - and I wish they would take more courses at W.P. Carey and Jay's school where we could teach them things. You're right. But it's problematic. People are still very myopic about taking enormous risks in the short run. And they get upset when they lose.

Ted Simons :

Dennis, You can teach people all you want, but the fact is if the regulators aren't regulating and the S.E.C. isn't doing its job, how do you correct that situation?

Dennis Hoffman:

Regulation certainly has a role. We talk about this and Tony and I taught many, many students in banking and financial markets. Individuals and businesses can always be to some degree a step ahead of regulators. We talked about how banks and financial intermediaries can be ahead of regulators to some degree. It's always going to be a challenge of keeping regulation up to snuff. But arguably over the last 10 to 20 years, certainly the pace of regulation has fallen quite a bit behind. At the end of the day, it just strikes me that getting out of this or dealing with this, Ted, is really going to be up to us. It is going to be up to consumers, it's going to be up to businesses to regain confidence. There's going to be a lot of discussion about what government should do, did do, didn't do, all of this kind of thing. At the end of the day, tax rates are at near historical lows, interest rates at near historical lows. Unfortunately, confidence has gone from obviously too optimistic to way overly pessimistic as far as I'm concerned. And until that comes back, I don't think anything is going to move.

Jay Butler:

Also, the problem with real estate you have too much inventory. So even if you have confidence, there really isn't a thing to make sense. You're losing tenants right and left. You have 50-60 thousand single family homes, more than the world needs. So it's going to take a long time to work the inventory over even if you have confidence. It used to be if the market gained equilibrium, then you gained confidence. Now there is so much overhang.

Dennis Hoffman:

We were just pointing out that some of this lack of confidence is very well founded. It is certainly understandable not to be confident.

Jay Butler:

I walked through a shopping center that was 80%-90% empty and a year ago it was full.

Anthony Sanders:

What do you think about the congressional proposal to help out homebuilders? This is the homebuilder bailout. We are going to offer 4½ % financing if you buy the existing inventory of homes. What do you think about that?

Jay Butler:

Well we're sort of into potato chips here. We should never have started the bailouts in the first place. Now we don't know where to end them. When we were bailing out the rum manufacturers, we were in deep trouble. The commercial developers now want bailouts.

Dennis Hoffman:

Targeting individual industries. Autos, and even though autos are in a tough spot, targeting autos. Targeting the builders. Wow! That's pretty tough.

Ted Simons :

But can this country survive if the automakers fail and associated - the rubber, steel industry - or even go into bankruptcy?

Anthony Sanders:

Let me make something clear, at least my view. The auto bailout, I think, is a flash point. The answer to me is that they can actually run the companies in bankruptcy and they can take the opportunity to reform them in a better model than they have been operating in the past. But simply bailing them out is just encouraging them to get into the same set of problems.

Jay Butler:

We're looking at the need to have time, the confidence to restructure. To be much more competitive in what we are doing.

Ted Simons :

Restructure means what?

Jay Butler:

Well, we don't know. That's the problem. It's like the infrastructure argument. We're talking public-private partnerships but nobody really wants a partnership. And, you know, we don't know. Nobody really knows. And this is going to be the next -- the big challenge of 2009 is putting together the components of the model for the new economy that the 2010 will begin to build on.

Ted Simons :

Is the idea of an economic stimulus plan, especially dealing with infrastructure -- Dennis, I know that you've been for this to a certain degree. Why does it make sense?

Dennis Hoffman:

I'm an infrastructure cheerleader, I am, Ted. But I was for infrastructure before it was cool. I've been this way for 10 to 15 years.

Ted Simons :

Why is it a good idea?

Dennis Hoffman:

I think infrastructure investments can play a key role, if done correctly, in economic development for regions, for states, and the entire country. I'm talking about transportation infrastructure, well planned,well thought out and I think there's plenty of evidence on this side. Communication infrastructure. Education infrastructure. All of those investments make sense to me.

Ted Simons :

If you're going to have federal money put into things, why not a stimulus package that involves infrastructure?

Anthony Sanders:

Well, the problem I have with infrastructure -- and again, I'm in favor of some of it, but there's an excellent article in Forbes. They rank ordered the citites most likely to receive the stimulus package that relates to infrastructure. They have Miami as number one, and Chicago and Detroit. Why Miami? What are the particulars? Because we have more projects under way. Can we have a review of these as a society to see? Miami is a disaster in terms of the housing market and the economy. So sometimes putting infrastructure in disastrous. Local economies may be a complete waste of money. We may increase some employment, but what is the net outcome? I agree with smart infrastructure, which is, of course, what Dennis is talking about.

Ted Simons :

The idea again, as Richard Nixon once said, we are all Keynesian now. Considering you've got the financial bailout and auto bailout waiting to happen and a number of other federal inputs into society, are we basically looking at a different way of doing things for the foreseeable future?

Jay Butler:

I think a lot of people are thinking that. I think one of the big fears I have for the coming years, there's high expectations for the new administration and when you have high expectations they're usually not met. That's my big issue, is that a lot of things are - going to be put forth infrastructure is going to employ 3 million people. But are people who worked at Lehman's and Goldman Sacks suddenly going to work on a bridge? I am not convinced that there are vacant jobs.

Dennis Hoffman:

Jumping off a bridge.

Jay Butler:

But yeah, and it's a whole mishmash of things. and you know, it's hard to figure out how it's going to happen and, of course, everybody has an opinion.

Ted Simons :

As far as Arizona is concerned. Incoming Jan Brewer administration, what do you see, as far as infrastructure plans and these sorts of things?

Dennis Hoffman:

They're going to think 24/7 about balancing a state budget, I think. Getting into plans for infrastructure for the state. Even though we passed some university legislation last year and they're waiting because they're afraid to spend a million or something, Ted, I'm not exactly sure of that. But it's certainly been put on hold.

Ted Simons :

The concept - Tony, I want to get with you, because there's concern that all of this federal money coming into the market, once we see a thawing of credit, and we starting to see a little of that but not a whole heck of a lot. Once that happens, there's a lot of money out there that means inflation, doesn't it?

Anthony Sanders:

Yes. The problem is it pumps so much money, liquidity in -- into the system and then you have the Feds talking about issuing their own set of bonds, independent of Treasury. We sort of looking at this going hey, hey. This is like government gone wild. This better be serious and once we turn around - so if the forecasts we're talking about, let's say second half of '09, we begin to see a little lurching of the economy - they have to go and withdraw a substantial amount of liquidity from the market. And that absolutely what they have to do. And that's allegedly why they have Volcker on the team. Because Volcker can do that. My concern is government responsibility. If you are out there and you have that much cash running around. It's going to take a pretty tough president and congress to sit there and really think about pulling that out of the market and that it's party time. Let's see if they do. I think it's in the best interest of the economy. Once we turn the corner, they have to pull that back, but will they do it? That is the million dollar question.

Dennis Hoffman:

Worrisome issues Tony is raising, but I'm not worried about those right at this moment. I really am not. He could be right down the road, but right now, it appears we have very few lending and very few borrowing. The opportunities are there. He's exactly right. The Fed has created the opportunities. The private sector hasn't seized them.

Jay Butler:

We have to recognize this is an international thing. This is not just Phoenix and the United States. All of these problems are throughout the world and it's going to take difficulty.

Ted Simons :

Gentlemen, we have to stop it right there. A great discussion. Thank you so much for joining us.

Coming up tomorrow on Horizon, it's the most fun you'll have looking back at the big news stories of 2008. Join two political cartoonists for an irreverent look back at the news. That's Tuesday at 7:00 on "horizon." On Wednesday, we'll bring you up to date with four politicians who have left the limelight in our Horizon special. Thursday, we are off for holiday programming. Friday, join us for another fun look back at the news with the journalists year-in-review. That's it for now. Thank you very much for joining us. I'm Ted Simons. You have a great evening.

Announcer:

If you have comments about Horizon, please contact us at the addresses on the screen. your name may be used on future editions of Horizon. Horizon" is made possible by the Friends of Eight.

Jay Butler:Real Estate Professor, Arizona State University, Morrison School of Management and Agribusiness;