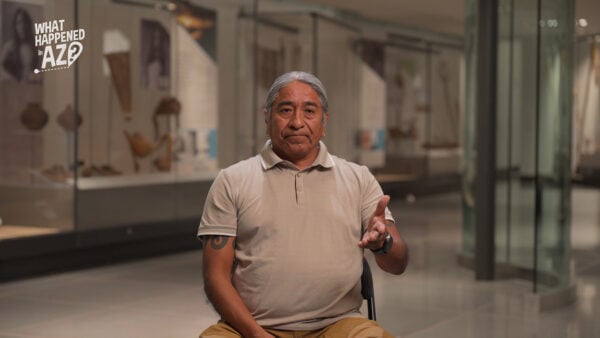

Arizona is one of five states included in a $1.5 billion federal program designed to help homeowners avoid foreclosure. Reginald Givens, a Foreclosure Assistance Administrator for the Arizona Housing Department,explains how the program works.

Ted Simons: Arizona is one of five states included in a $1.5 billion federal program designed to help homeowners avoid foreclosure. Arizona's share of the foreclosure assistance funds amounts to $268 million with the money administered by the State Department of housing through a program called save our home AZ. Here to talk about it is Reginald Givens. Good to see you again.

Reginald Givens: thank you.

Ted Simons: give me a better definition of save our home AZ.

Reginald Givens: Save our home AZ is designed to assist home owners the avoidance of foreclosure. It provides a number of types of assistance but ideally it's for the consumer who are who either first cant afford their mortgage payment, second is delinquent on their mortgage payment, incapable of getting current, or third may be struggling from negative equity, commonly referred to as being under water.

Ted Simons: it helps those facing foreclosure. Are we talking mortgage modification? What is the assistance?

Reginald Givens: There's the gambit that it runs. What we do first of all is receive an application online from a consumer requiring assistance. We evaluate their circumstances based upon the documentation and make a determination what's best for them. There's principal reduction, in some instances, all of this can come up to $100,000 of assistance. Whereas they may owe $300,000 on a house now worth $200. They qualify. We would provide $100,000 to reduce the principal balance, so what they owe becomes in line with the current value of the home. That's the modification that has non matched dollars for principal reduction.

Ted Simons: there's also short sale assistance. What kind of help does that involve?

Reginald Givens: Short sale is for the person who has either decided that they want to transition out or circumstantially need to transition out. We can help them with $4500 of assistance as they sell the house, what's commonly referred to as cash for keys, we help with 3% of closing "Consumer Reports." That helps with marketability of the property. We can extinguish Junior leans in that process, which is needful in that short sale.

Ted Simons: the second elimination, who qualifies for that?

Reginald Givens: Again, the general qualifications for the program are universal. If I may give you five. The property needs to be in Arizona. Needs to be a primary residence, where you live. You have to have an eligible hardship and we can talk about that but basically it consists of three aspects. Nonself-inflicted, income reducing and non affordable payment producing.

Ted Simons: It sounds like, then, unemployed, under-employed, they qualify?

Reginald Givens: Those are almost a SHOO-in. If you're unemployed and you didn't do anything to become terminated or unemployed you're going to fit the program. We subsidize those up to $2,000 a month for as long as 24 months. The assistance is significant, allowing the household the opportunity to reestablish themselves.

Ted Simons: interesting, two years. That's a deadline. That's ballgame.

Reginald Givens: exactly. Two years. But that's proven to be significant and sufficient. We have helped a number of households we may have assess at the time up to 12, 18 months now. They have been gainfully reemployed and they are maintaining their home on their own.

Ted Simons: Eligibility regarding Fanny, Freddy, FHA, they do not qualify?

Reginald Givens: They do qualify. Various aspects of our assistance requires certain level of investor approval or cooperation. Some aspects just get it across the board. Under the unemployed and under employed and reinstatement we hope to bring the household current no investor will say no. We help them receive monthly the contractual payment due them. When it comes to principal reduction and we want them to match there was resistance, which is why we have eliminated the need for the match. Your loan could be owned by Fannie Mae or Freddie Mac and we can provide you assistance to modify that payment that most likely will cut it by more than a third.

Ted Simons: I heard these federally guaranteed loans did not qualify necessarily.

Reginald Givens: right. It used to be. It's changed. The program has evolved. This started in October of 2010. We have had so many iterations of our policies, to effectively deploy the money in the market given the barriers to accomplish the objective.

Ted Simons: tax consequences here?

Reginald Givens: This is a great thing. The dollars have already been deemed for the general welfare of the public, therefore none of the assistance is taxable to the consumer. It does a major service for our marketplace. We have avoided 800 foreclosures.

Ted Simons: some folks are renters in property that looks like it's facing foreclosure. They are wondering, is there some way to get that money even if the owner is not interested, they don't want to move. Anything for them?

Reginald Givens: Nothing on that level for this program because this is all about homeownership for the consumer that currently owns and has to transition out. However, for the consumer looking to acquire, in our marketplace has an interesting dynamic going on in that the market is pretty solid and starting to improve, when a consumer is short-selling their house in that space our assistance can provide some closing cost assistance to the person buying. So it's helpful to look at short sales where before people would shy away from them.

Ted Simons: it's also helpful to know whether or not you're eligible. For more information we have the website up there.

Reginald Givens: That is the place to go. The program I like to say is web-based and consumer driven. You must complete the online application and you as a consumer have to remain invested in the process.

Ted Simons: So AZhousing.gov gets you going.

Reginald Givens: exactly.

Ted Simons: are people taking advantage of this? Is it starting to get some traction?

Reginald Givens : I'm glad you have us on here so we can help more people become aware of it because it can do a lot more than it has. It's gaining traction and that's great.

Ted Simons: good stuff. Thanks for joining us.

Reginald Givens: Thank you.

Reginald Givens:Foreclosure Assistance Administrator, Arizona Housing Department;