Part one

We begin a four-part series looking at the status of the Arizona economy. Tonight we focus on the real estate market. Guests include Jay Butler of ASU Realty Studies, Elliot Pollack of Elliot D. Pollack and Company, and real estate analyst R.L. Brown, who writes the R.L. Brown Housing Reports.

>>Ted Simons:

Tonight on "Horizon", we begin a four-part series, examining the state of the local economy. Tonight, Real Estate. And issues with the State Legislature, upcoming elections are confronted by our political antagonists in "One-On-One". That's next, on "Horizon".

>>Announcer:

"Horizon" is made possible by the "Friends of Eight": members of your Arizona PBS station. Thank you.

>>Ted Simons:

Good evening, and thanks for joining us tonight on "Horizon," I'm Ted Simons. A bit of positive news today on the economy. For a second straight month, there was an increase in the Conference Board's Index of Leading Economic Indicators. That's the first month-to-month gain since October of 2006. An economist for the Board said in the Wall Street Journal that the increases could mean the local economy may not weaken further. For the average Arizonan, however, that may not be much comfort, as gas and food prices continue to rise. The slowdown in Real Estate has begun to affect manufacturing. Auto and furniture sales are down, a result of the lack of equity. We begin a four-part series tonight, "Arizona's Ailing Economy". We look at several things that could be affecting your wallet. Tonight, we focus on Real Estate. Here's a look at some of the current numbers.

>>Larry Lemmons:

Last year, the demand for new homes fell considerably, and builders around the country found themselves in possession of a surplus of unsold homes. Now comes news that the construction of new homes increased in April for the first time in two years. The Commerce Department reports that housing construction rose by 8.2% in April 2008, although the growth primarily came from a rise in apartment construction. Locally, R.L. Brown reports there were nearly 1,900 new home closings in March, which was short of what it was last year at that time, but up from what had been occurring recently. ASU analyst Jay Butler reports that Greater Phoenix resales also posted a small increase in March, but many of those were foreclosure sales. Foreclosures were up 65% nationally from last year. Arizona is one of four of the hardest-hit states with a foreclosure rate of one filing per 224 households. There were over 5,500 resales in the Greater Phoenix Area in April, which was the first time in nearly three years the area saw year-over-year improvement. the resale median home value fell in the first quarter to $210,000 from a little over $260,000 in 2007. The new home median price also fell to just over $250,000, from nearly $300,000. Analysts are unsure if the positive numbers in April are signs of a recovery or an anomaly.

>>Ted Simons:

And joining me to break down the numbers, and attempt to see where we stand: R.L. Brown, author of the "R.L. Brown Housing Reports", Elliot Pollack of Elliot D. Pollack & Company, and from ASU's Realty Studies, Jay Butler. And good to have you all in the program. Thanks for joining us.

>>R.L. Brown, Jay Butler, Elliot Pollack: Thank you.

>>Ted Simons:

Alright, Jay, these latest numbers - foreclosures, new home starts - we saw them. What do they mean?

>>Jay Butler:

Up to 2,000 foreclosure transactions, so it's more of a blip in the road. so it's not - the good news is, if you want to buy a home, it's a great time to buy one, because there's a lot of product out there. But most of the sales activity, almost a third, is in stuff going back to the lender.

>>Ted Simons:

R.L., are the numbers any kind of indicator of something?

>>R.L. Brown:

We think they are. We have a little bit differing view than Jay, perhaps. we've seen stability grow in the housing market over the last eight months. as far as new home closings are concerned. And also, the fact in the numbers we just calculated this week for April. We've also seen stability in permits in the Metropolitan Phoenix Area. So, that says to us, from our perspective, that we are somewhere bouncing along some kind of a bottom in the market. There was an uptick, as Jay indicated, in resales this last month. And there was an uptick - a minor uptick - in new home permits this month. Those are all positive signs, so we think that we have, perhaps, seen the worst. Even though it's a long way from a recovery, if we define recovery as something moving back towards 2005.

>>Ted Simons:

Elliot, the numbers: Anomaly? Stability? Somewhere in between?

>>Elliot Pollack:

R.L.'s right. It's a question of whether the glass is half full or half empty. He's half full, I'm half empty. They stabilized 72% off the peak of 2005. And so, they're bumping along at roughly 15,000 permit, 20-some odd thousand closings, a very low level. And it appears to me they will bump along here for quite some time. I think we have quite a way to go before we deal with the problem, which is this excess supply. You have to absorb it, and that's going to take time.

>>Ted Simons:

How long will that take, and how far do prices have to drop?

>>Elliot Pollack:

Well, prices have fallen a lot. 24% if you believe the Schiller Index, 21% if you believe the resale numbers. I believe they will drop farther. I'm not sure how much farther, but they will drop farther until supply and demand get back into balance. R.L. probably has better figures for new homes, but I think this is going to take a while. I agree with Jay, it's a great time to be a buyer. And you got to look at housing as a commodity. You can't fall in love with it, it's just a commodity. And if you're out there making offers, you're going to find incredible deals.

>>Ted Simons:

Jay, you say it's a great time to buy if you're looking, but isn't it true that if you're looking in, let's say, Pinal County, it's maybe a great time to buy, but if you got something that will ever appreciate?

>>Jay Butler:

You do, if you have time. A lot of the people who are buying in Pinal are activities up in the Queen Creek areas, the Anthem areas. So basically, buyers are non-locationally challenged. they are retirees, they're second home people. This is a great opportunity. The big issue is when the market was skyrocketing at Pinal, the people who worked there couldn't afford to live in Pinal. Now they can. And tthen you have the investor group who believes that this is going to do. So, there are opportunities, as long as you don't want to make that commute.

>>Ted Simons:

What kind of indications should we see, as people out there watching the market? What should we look for to suggest we are indeed at bottom, and are going to start bouncing up here shortly?

>>R.L. Brown:

We will begin to see that there is a stabilization in the pricing. Elliot's right on target. as long as there's an oversupply, prices will continue to feel downward pressure. And it's our feeling that we're not that far from a stability in pricing in the new home side of the marketplace, as far as the median price is concerned, and we have quite a ways to go yet in the resale market. Our feeling is the new home median price is probably going to have to get down into the range of $195,000. The resale price, probably, into the $140,000-$150,000 median. That would put it back about the same range as we saw in 2001 or 2002.

>>Jay Butler:

But you got to be a little careful. Some markets -

>>R.L. Brown:

Absolutely

>>Jay Butler: -

For example, the Tempe-Mesa markets, are dropping 2 or 3% over a year ago. They don't have the sales turnover, as they are a much more stable market. Where the real drop in price, which is dropping the overall median, is those Western communities and those outriding communities that are heavy commute, where investor heaven, or whatever the reason is, So, the recovery is going to be more in some markets, and some markets aren't doing that badly.

>>R.L. Brown:

That's right, it's strictly a neighborhood thing. And the judgment call is going to have to be made on a neighborhood-by-neighborhood basis, as to when you should buy or I should buy.

>>Ted Simons:

How much is the economy affecting housing, and vice versa?

>>Elliot Pollack:

Well, it started out that the housing market was affecting the economy. The economy was fairly strong when this started. But you're now at the point where the economy is turning sour, which means more foreclosures, more affordability difficulties, more psychological problems, in terms of how wealthy people feel, and whether they're going buy a house. Just like three years ago, was "we better buy before prices go up". Now, it's "we can wait awhile, because prices are going down. So, the psychology's a flip from where it was three years ago, and it's going to take awhile to resolve.

>>Jay Butler:

But you also had the issue, it's "are we going to have a job six months from now?" And the watercooler talk is a big issue. One of the things in all the programs developed over the last year to help the troubles homeowner is premised that you had a job or income. Now, those may be in difficulty as we see layoffs and other things begin to take hold.

>>Ted Simons:

R.L., you - Go ahead.

>>Elliot Pollack:

And that's a big deal with the foreclosures. Because basically, we weren't doing poorly in foreclosures until fairly recently, when the economy weakened. A weak economy causes people to have to lose their homes. So on top of this huge oversupply, you now have this economic overlay, and it's going to be painful.

>>Ted Simons:

You mentioned neighborhood-by-neighborhood a few minutes ago. Give us some neighborhoods where things aren't so bad, and give us some neighborhoods where things are really bad.

>>R.L. Brown:

You can tell pretty clearly, if you're a consumer, as to what neighborhoods are not doing too bad, and that's how many "For Sale" signs are on the street. - and it's not gonna make any difference what size or range it's in, or what part of town it's in. If you see a neighborhood, a subdivision or a community or a couple of blocks where there are very few for sale signs, then you can come pretty close to an assurance that that neighborhood has got some price stability. On the other side of the coin, you go down one of the streets, and we've all been down them, where every house has a "For Sale" sign in front of them, and half of them say "For Sale by the bank", there's no price stability.

>>Ted Simons:

Speculators: obviously a major factor in the housing market, I think most would agree to that. Prices come down, eventually, interest rates stay down, let's say, for argument sake. What's to keep the whole thing from happening again?

>>Elliot Pollack:

Well, the set of circumstances that caused it, I think are unique, and I don't think will occur again for 20, 30 years, to be honest with you, in terms of the psychological impact of "buy now before prices go up", of all the speculation of home builders buying into that type of stuff, and therefore oversupplying the market. Essentially, the people who weren't going to live in the homes. The last time this really happened was, what, the '60s? It's been a long, long time. So, I really think this is not going to happen again. Home builders are basically going to be very cautious with their inventory, and who they sell to. And prices will not balloon again for a long, long time. And I think that will prevent investors from going hog wild again.

>>R.L. Brown:

And credit, the other part of that equation, was that anybody could get credit for anything, and that's not going to happen again for a long, long time.

>>Jay Butler:

Also, everybody was a speculator, even if you bought the home to live in, you were speculating that the increases were going to continue to go up, and either you can sell the home or refinance it to support your lifestyle. Everybody was sort of speculating on that ever-ratcheting number. The people who really got hurt were the amateur speculators, who were buying homes to rent out, and they paid more than what they could rent them for. Or the flipper who got crushed.

>>Ted Simons:

As far as condos are concerned, we've talked in the program before about luxury condos, not-so luxury condos, how is that market doing?

>>Elliot Pollack:

The market's got problems, probably more so than the overall housing market, in that the market's simply not as deep, and there's a fairly significant supply. So I think that the high-rise condo market is going to be difficult for quite some time.

>>Ted Simons:

Agreed?

>>R.L. Brown:

I absolutely agree. We have a lot of suffering to go through for the high-rise condo market in Metropolitan Phoenix.

>>Jay Butler:

Yea. Basically, it's not a proven lifestyle in Phoenix. The other thing is, anything of above 417, the nonconforming low mark, which were more of these condo set, you either pay 100.5% more on the interest rate, 20% down, etc. So, it's hard to even get financing if you want to buy one of these things.

>>Ted Simons:

Overall, in general, you look at the prices in '01, '02, '03 - do we go back? Is that where it's going to wind up?

>>Jay Butler:

Somewhere in that neighborhood. We're on the median price in most areas, we're sort of back to where we started in 2003.

>>Ted Simons:

What do you think?

>>R.L. Brown:

We're not quite back there, but again, on a neighborhood-by-neighborhood basis, there would be some neighborhoods that we were. But definitely, we're going to be regressing to that kind of a level.

>>Elliot Pollack:

I think if you take the trend line between the early '80s, and the early part of this decade, 2001, and 2002, and you trimmed it out, we'll be back there by the end of the year. The entire bubble will have disappeared.

>>Ted Simons:

Last question: and obviously, you know your business, and you've been around more than one block. Did any of you in 2005 stand up and say, "watch out", "look out"? Did any of you see this coming?

>>Elliot Pollack:

I think we all did.

>>Jay Butler:

We all did.

>>Elliot Pollack:

I think we all said, "watch out". I think what is difficult to see when you are in that type of situation we were in is how bad it's going to get, or how long it's going to take. But I think everybody around this table understood it was something terribly out of the ordinary, and something was going to end up not well.

>>R.L. Brown:

We are all cognizant of the fact that affordability, as a part of the housing equation in Metropolitan Phoenix, was going away. And I think every one of us, in our individual writings, cautioned about the - if affordability goes away, a lot of other things go with it. And that's precisely what happened.

>>Jay Butler:

I think everybody believed it was going to go away, but not as soon as it did. Because we were only in this hyper market for about 18 months. San Diego and Vegas were much longer. And there's just a general belief that the market will turn south the day after I sell my home. So there was a general belief that it was going to continue.

>>Ted Simons:

Alright, we'll stop it right there. Gentlemen, thank you so much for joining us on "Horizon".

>>R.L. Brown, Jay Butler, Elliot Pollack: Thank you.

>>Ted Simons:

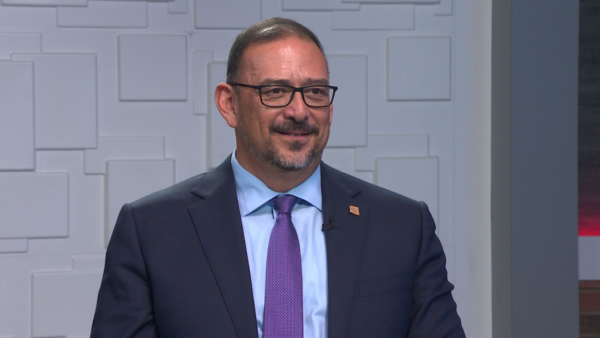

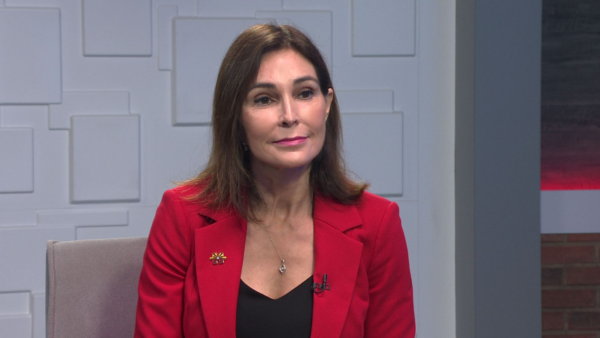

Now for our regular Monday feature, focusing on issues of concern for those watching the State Legislature and upcoming elections. Two political type go "One-On-One". Tonight, John Munger, attorney for Munger/Chadwick, goes head to head with John Loredo, a political consultant with Tequida & Gutierrez.

>>John Loredo:

John, good afternoon.

>>John Munger:

Good afternoon, John. It's good to see you.

>>John Loredo:

Here to talk about a few things. Last week, Governor Napolitano signed an Executive Order that directed the Department of Public Safety to redirect a line item, some grant money that was going to Sheriff Arpaio to do immigration enforcement, She redirected around back to DPS to do kind of a fugitive task force. It started kind of a firestorm going back and forth, a war between Napolitano and Arpaio, kind of a war of words.

>>John Munger:

Right, yea. It's been interesting to watch. I took the opportunity, John, to look up the legislation of where this appropriation came from last year. It's House Bill 2781, and in that legislation, it expressly states that that money would be used for the "Get'em" Taskforce, which, you know, is the gang taskforce, not for felony warrants. So it appears to me the Governor has diverted this funds from what it's explicitly appropriated for in the bill, and diverted it to uses not authorized in the bill. So I think people are saying she's inappropriately and probably illegally diverted those moneys are probably right.

>>John Loredo:

I think that, you know, the "Get'em" Taskforce is going to be doing the enforcement in going after these people with felony warrants. I think what it really comes down to a prioritization of State funding. When you have all of these felony warrants that are outstanding, the majority of them being - over 48,000 of them being in Maricopa County. These are criminals, these are violent felons that are walking the street with nobody looking for them.

>>John Munger:

That may be true, John. Some of them may be, and some of them may not be. But the legislation specifically says this money's to be used for gangs and illegal immigrants. It's not to be used generally to find and incarcerate anybody who has a felony warrant. My concern, and I think the concern of the people opposed to her diversion of moneys, is she's diverting money to uses that aren't authorized in the bill, that have nothing to do with immigration. And the bill is explicit that that money is appropriated explicitly for gang-related immigration, principally human smuggling. So the human smuggling, immigration, gangland issue is not going to be addressed. I frankly think that what she's doing here is she's after Sheriff Arpaio. She's making a political statement. And I think it's inappropriate. she's not the queen, she's got to respond. She's the one - she signed this legislation. She ought to honor the legislation. This is not the way government ought to work.

>>John Loredo:

I think as long as as the "Get'em" Taskforce focuses on people who are gang members, or people who have outstanding felony warrants who are undocumented people, then I think it fits the intent of the legislation.

>>John Munger:

That's not what she's doing. She's just authorizing this money to be spent on anybody who's got an outstanding felony warrant. That's, I think, the concern. The money's pretty well explicitly appropriated. I think it's a shame, Sheriff Joe does a great job. He's a wonderful law enforcement officer, and frankly, I think if he's doing that job, it's inappropriate to take the money away from him. The legislature certainly doesn't think that's the spirit of the deal, and I hate to see this State operated that way, because I don't think that's - I don't think that's cooperative management.

>>John Loredo:

And I think it's just a matter of priorities. Sheriff Joe's doing a great job of rounding up - going on, racially profiling people, and rounding up gardeners and cooks. You know, every other person walking down the street. And out of all of the people that he stops, a very low percentage of them he actually arrests for being here illegally. So the issue is: do you want taxpayer's money spent rounding up gardeners and cooks, or do you want to go after violent felons?

>>John Munger:

But that's not where this money is not being used. This money's being used that we're talking about here.

>>John Loredo:

No, as far as roundups

>>John Munger:

No, it's not being used for sweeps. It's being used for his Gangland Human Amuggling issues, which is totally different than the sweeps. This money is not being used for the sweeps. It's being used by Sheriff Joe for gangs that are doing human smuggling. And that issue, I think, is being left on the table by the Governor. Now, we don't have that enforcement going on by the largest law enforcement agency, I think, in the State.

>>John Loredo:

Well, the good thing is he has been invited to join the new taskforce for felons. We'll see what happens, and we'll see how this plays out next legislative session, during budget time.

>>John Munger:

Meanwhile, she's gonna let the human smuggling issue go.

>>John Loredo:

Well, not if they have a felony warrant, she'll be going after that. On another issue: the issue of the State Budget kind of drags along. Today was the 127th day of the Legislative Session that was supposed to wrap up about 27 days ago. The per diem has been cut down, I believe last week, to $10. So that may be a little bit of a motivation to get people going. I know the way that it works down there, and I think as this thing drags on during campaign season especially, members start to get really, really nervous that they're down, sitting around at the Capitol, wasting time instead of out knocking on doors in their districts.

>>John Munger:

I think that's right. The key is: it's an election year, and I think that's very important. I think you're right, I think we're going to get a budget here pretty quick. Let's talk about something else that is happening. That's this whole issue with the ongoing dispute between Mr. Obama - Senator Obama - and his interpretation of the President's comments. I think that's very interesting. You know, my take on that, John, when the President made this speech in the Middle East to the Israeli Knesset (Parliament) about the fact that it's American policy, he simply stated American policy that had been stated for seven years under his leadership, that we will not negotiate with terrorists. And somehow, Mr. Obama took umbrage at the thought that the President would make this speech. Well, he is the President. he does articulate American policy. But what was really interesting is Mr. Obama took offense at that. He thought that was politically aimed at him. My take on that is: "if the shoe fits, wear it!" If it doesn't, don't worry about it.

>>John Loredo:

I think the big issue is that President Bush during his speech - it wasn't necessarily a Presidential speech as much as it was a campaign/election year speech. And in suggesting to the Knesset, of all people, that somehow or another, Mr. Obama would go and make friends with Israel's enemies -

>>John Munger:

But he didn't say that.

>>John Loredo: -

and that would threaten, in some way, Israel, I think is a big mistake, and I think the reality is that what this all goes back to is Senator Obama's remarks that he would be willing to sit down and talk with leaders of foreign countries. It doesn't say he'll sit down and negotiate things away with these people.

>>John Munger:

Well, here's the problem. Number one: the President didn't mention Obama at all. Senator Obama's name was -

>>John Loredo:

He did allude to the Democrats, and the nominee.

>>John Munger:

No. Well frankly, President Carter had just gotten back from doing that very same thing, negotiating with terrorists, and it seems to be the Democratic policy -

>>John Loredo:

But he didn't negotiate. He didn't negotiate anything.

>>John Munger:

Yes, he did. He negotiated with terrorists, and he gave the terrorists -

>>John Loredo:

But what did he give up? Nothing!

>>John Munger:

He gave them the most prestigious thing we have to give, and that is the ability and the recognition and the "imprimatur" that comes with negotiating with the President of the United States. That is a ticket. That's prestige is not something you give up to anybody.

>>John Loredo:

But you don't gain peace in the Middle East by ignoring one side and just dealing with the other -

>>John Munger:

Nobody is ignoring -

>>John Loredo:

You have to bring both of them together. Which is something that George Bush ignored the first term of his Presidency, until it explodes.

>>John Munger:

What you need to understand is that we are negotiating with them, but not the President, and we are trying to get the Europeans together to impose sanctions. We are meeting with them around the table. but having a President go in, and lend his "imprimatur", and his prestige, to the President of Iran, who, incidentally, has about a 20% population support, the President is going to be in a position where, if he shows up, he's going to be giving support to a man who's very weak.

>>John Loredo:

But you remember in the Middle East, I mean, it was Jimmy Carter, the President that bought Menachem Begin and the President of Egypt together -

>>John Munger:

They were not terrorists. No, they were not -

>>John Loredo:

You've got - well, Egypt was a supporter of terrorism against Israel. But the reality is, you need leadership at the top to bring those sides together.

>>John Munger:

But you don't give away the American prestige that easily.

>>John Loredo:

Unless you want peace.

>>John Munger:

You negotiate in a tough way with underlings. And when you finally get, as President Bush is doing, and then you bring it together with - But the Presidential prestige is the ultimate, and you don't give it away like Mr. Obama wants to give it away.

>>John Loredo:

We've got to go, but we'll see you next time.

>>John Munger:

Thank you, John.

>>Ted Simons:

Tomorrow on "Horizon": mortgages, car loans, credit cards, many people are deep in debt because of our ailing economy. In part two of our series, we look at the credit crunch. And the economy is also affecting Arizona's job market. We'll talk about employment issues as well. That's Tuesday, on "Horizon".

>>Ted Simons:

That is it for now, thank you so much for joining us. I'm Ted Simons, you have a great evening.

>>Announcer:

If you have comments about "Horizon", please contact us at the addresses listed on your screen. You name and comments may be used on a future edition of "Horizon".

>>Announcer:

"Horizon" is made possible by contributions from the "Friends of Eight": members of your Arizona PBS station. Thank you.

R.L. Brown:Author of “R.L. Brown Housing Reports;Elliot Pollack:Elliot D. Pollack & Company;