A legislative panel is searching for ways to stop reported abuses in Arizona’s tuition tax credit law. Meanwhile, there are those who say the law cannot be fixed because it’s unconstitutional. Hear what Institute for Justice attorney Tim Keller and AEA President John Wright have to say about the issue.

Ted Simons: Today at the state capitol, a bipartisan taskforce began looking into reported abuses of Arizona's tuition tax credit law. The law was intended to help low-income students attend private schools. Here's how it works. To qualify for the maximum allowable $500 individual income tax credit, a person must contribute at least that much to a school tuition organization. STOs then use that money to give private school scholarships to kids. They're supposed to go to kids who otherwise are not able to afford private school, but an investigative series by "The East Valley Tribune" revealed that's not always the case. In the following segment, you'll hear from a reporter who worked on the series, followed by an NAU accounting professor who testified at today's hearing.

>> Federal tax law forbids donations that are earmarked or designated for a -- to benefit one person. It's not charity if you're saying I'm just going to give money to help this one person. If you're giving money to a charity to disburse based on need and other things, that's charity. Instead of calling these earmarks, they call them recommendations and we found from actually going out and talking to parents and schools and reading surprisingly blunt details that schools publish describing how these works, they just change the wording thinking that will allow them to be within what the law allows, and at least on the fed side. The state law doesn't even address it.

Ted Simons: I was going to ask about oversight, you're saying no state oversight?

>> There's no actual regulation of the system by the state.

Larry Mohrweis: The reporters for the "The East Valley Tribune" and the "The Arizona Republic" did an excellent job of identifying many of the problems, many of the issues that have taken place. Where I think is lacking is looking on the other side of the ledger. That it's a balanced approach. A recognition that there are school tuition organizations out there that are doing exactly what you want them to be doing. It's the legislature's job as policymakers to clearly outline what you consider to be acceptable. And it is clearly the STO organization's job to make sure that they are not being just conduits passing donations from grandma or donations from aunts and uncles to nieces and nephews and -- and to children. And that's -- that's why I would like to see the overall policy be improved and I still stand on a position which is very controversial because some do not like that, but I still stand on the position that scholarships should be based on financial need and not earmarked for a specific child.

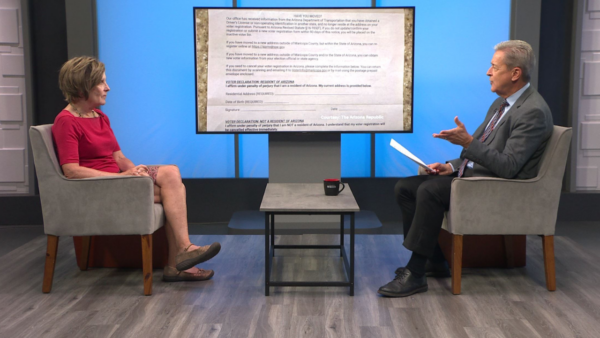

Ted Simons: While the taskforce is looking into ways to improve Arizona's tuition tax credit law, there are those who believe the law is unconstitutional. They say it violates Article IX Section X of the Arizona Constitution which states, "No tax shall be laid or appropriation made in aid of any church or private or sectarian school or any public service corporation." A challenge to Arizona's tuition tax credit law is up for review before the Arizona Supreme Court. Joining me is John Wright, president of the Arizona Education Association, one of the groups behind the challenge. And Tim Keller, an attorney for the Institute For Justice, which is defending the state's tuition tax credit law. Good to have you both back on "Horizon." Thank you for being here.

John Wright and Tim Keller: Thank you.

Ted Simons: Let's start with the idea that the law needs to be reformed. Agreed?

John Wright: It's a simple reform to make this law better and that's to repeal it. It's not good education policy and I believe the Arizona Supreme Court will rule it unconstitutional when they act.

Ted Simons: Between now and then and if they act in a direction that may not to be to your liking, reforms needed then?

John Wright: As we heard on the report, there's no oversight and regulation and no real guidance about how these tuition organizations should be functioning. The money is not going to the students that it was intended to support. You have people from both sides of the political spectrum saying this isn't the way it's supposed to work. Trent franks, himself, has said this has gone awry. This isn't what we meant. When you have subsidies for students already attending private school and parents who are capable of paying the money who are getting the money funneled into their private account.

Ted Simons: A lot of people say reform is needed. Do you agree?

Tim Keller: Yes, for better or worse, the recent spate of news articles by the "The East Valley Tribune" and the "The Arizona Republic" have tarnished the reputation of this tax credit. Therefore, the most important reform that the legislature can pursue is transparency. That means additional reporting requirements placed on the school tuition organizations receiving these donations from taxpayers. The reason transparency is important because once we know more about who these scholarship organizations are funding, what we'll see, the vast majority of them are going to families in need. One of the things that the "The East Valley Tribune" failed to do was actually document any large or vast problems with the program. Instead, all they revealed was four families who said they could probably afford the tuition without scholarship assistance.

Ted Simons: When the paper investigation says tax credits are not making private schools more accessible, you say?

Tim Keller: They're absolutely wrong. And, in fact, their own articles make the point for me. The "The East Valley Tribune" says there were at least seven school tuition organizations issuing scholarships based on what the paper says is appropriate means. Based on financial needs. But they only named three of the seven. Those three fund 10,000 scholarships annually. And that's a third of the scholarships going to kids who desperately need the financial assistance. If you factor in the other four unnamed, probably up to half and then the Tribune failed to say that the other STOs, financial need isn't the only criteria; oftentimes, it's one of the criteria they use.

John Wright: I don't think we can't deny the data that there's widespread abuse and exactly the kind of abuse that the AEA pointed out when we first argued the case back in 1997. I think there's more than transparency needed. There's transparency now that has exposed some of this abuse but there's nothing to be done about it. We need not just transparency, but enforcement mechanisms. Something has to happen to people who are misusing public dollars like this.

Ted Simons: Are the STOs doing what they're supposed to do and not allowing for earmarks or are they being lost in all of this?

John Wright: I don't know if they're being lost in the eyes of those promoting the STOs, but I know what is being lost. Funding for public schools where 90% of the students attend. We have 37 students in a 25-station chemical lab and subsidies going to private schools. That's not good public policy.

Ted Simons: The paper reported that tuition at private schools, instead of going down, has gone up, along with reports that it wasn't as accessible as it should be for private -- basically what they're saying, the goals were X, Y and Z, and they aren't happening. We've had congressman franks on here saying that it's not really working out. They were supposed to be designed for poor kids. It sounds like there are a lot of ways to reform here.

Tim Keller: What I'm saying is that the program is in large measure working as it was originally designed and intended to function. That is that there are tens of thousands of kids receiving scholarships based on financial need and attending private schools they couldn't otherwise attend. The idea is we're going to empower parents and based on the simple premise there's no one size fits all approach to education and there's no one better suited to decide where the child's proper placement is than that child's parents. That's going to include public, private, charter or home schools and what they've done with this program is empower parents who otherwise couldn't afford private schools to add that to the legitimate array of options they have in Arizona.

John Wright: I want to tell you, I agree with everything that Tim said, except it shouldn't be done at taxpayer expense. Choice, opportunity empower parents, find scholarships and give low-income children the chance at multiple institutions. Do it through donations. I think Arizonans have the biggest heart if there's a place they can contribute to as a charity and get a deduction on the income taxes. There can't be a dollar for dollar tax credit that siphons money off of traditional public schools.

Ted Simons: And that's your idea, because what? Essentially you're saying this is government sponsored.

John Wright: It's a scheme to permit these organizations to do in one fashion what the constitution prohibits them to do. We've had a court ruling that says vouchers are unconstitutional. You cannot take a dollar of tax money to pay a dollar of tuition. It's a back-door way of doing it. I think the Supreme Court will see it that way.

Tim Keller: The Arizona Supreme Court has already considered and rejected every single one of the teachers' unions arguments against tax credits. 1997 they filed a challenge to the individual tax credit program which was rejected and the court said three things with regard to article IX section X. These aren't appropriated funds. They're dollars donated by individuals and now corporations to the school tuition organizations.

Ted Simons: I want to stop you because I've heard this argument many times and what I keep hearing, these are not donated dollars. They're not contributed because basically if you're making the donation, you're using money that would otherwise go to the general -- you're not using your money. You're not out the money.

Tim Keller: These are individuals who have to at the end of the tax year write a check to a school tuition organization for their contribution. Yes, they receive a tax benefit. It's a dollar for dollar tax credit. There's no doubt about that, but these are funds that they have to decide whether or not they're going to give. There's no state-sponsored encouragement to do one thing after another. Donations to the citizens' clean elections act.

Ted Simons: Cut it in half, 50-cents on the dollar.

Tim Keller: I don't think it changes the constitutional issue one way or the other. These aren't state appropriated dollars. The other thing, they're not taxes. This is -- this is -- the argument that the teachers' union presented is that they get a credit against their taxes. That argument is a slippery slope. All of our money belongs to the state unless the state decides to let us keep it.

Ted Simons: Are tax credits done for if this credit is done for?

John Wright: I think you have to look at tax credits in general as economic policy and revenue policy. And I think if we identified this particular program as unconstitutional, you would see other tax credit schemes as unconstitutional as well. For other areas where we have tax credits and there are a number of others, I think that state government's not doing their job. If they think a particular program is important enough, they should appropriate money and support that program. The state government cannot legally support private or religious schools and this is a back-door way they're trying to do it.

Ted Simons: You don't see individual charitable donations in this money?

John Wright: Not a tax credit. I think Arizonans will make individual charitable donations and support causes like this. We do it through our churches and United Way. They will make the contributions necessary. They don't have to be coerced.

Ted Simons: Why not deductions as opposed to tax credits?

Tim Keller: Tax credits are a way to encourage citizens to engage in positive social policy and there's no doubt that the Arizona legislature has decided that providing aid to families to empower them to choose private education is good social policy.

John Wright: I don't think Arizonans need that kind of encouragement. I think they're willing do it without that coercion.

Ted Simons: If the courts continue to let this stand, how much reform is needed? Overhaul the program? Fine-tune? What needs to be done?

John Wright: I think there's an overhaul that needs -- that will be required. We have legislators that vote and earn a profit from these programs when they go to work after legislature is out of session. We've seen examples and it's probably just scratching the surface of the abuses and I think top to bottom, we have to look at how the state accounts for this money.

Ted Simons: Overhaul or simple reform?

Tim Keller: Simple reform. Transparency and empower the Arizona department of revenue to rein in any bad actors violating state or federal law.

Ted Simons: That means increased regulation. Are you ready for it?

Tim Keller: Ready.

Ted Simons: Thank you very much for joining us. We appreciate it.

John Wright and Tim Keller: Thank you.

Tim Keller:Institute for Justice Attorney;John Wright:Arizona Education Association President;