For the first time since 2007, average home prices went up in the Valley from one month to the next according to a new report from Arizona State University’s W. P. Carey School of Business. Learn more about the report from ASU economist Karl Gunterman.

Ted Simons: For the first time since 2007, median home prices went up in the valley from one month to the next. That's according to a new report from Arizona state university's W.P. Carey School of business. Here now to talk about the numbers is the man behind the report, ASU economist Karl Guntermann. Good to have you here, thanks for joining us.

Karl Guntermann: Nice to be here.

Ted Simons: All right. Median home prices up month to month, first time since 2007. Why?

Karl Guntermann: Well, I think the market is finally stabilizing. Prices have been falling a lot of foreclosures and prices are down to a point where there's a lot of buyers in the market, demand's picking up and prices are stabilizing.

Ted Simons: We're talking a relatively slight change here though, correct? Something like 2%.

Karl Guntermann: That's correct, yeah. I don't want to overstate it. You know, with all the bad news we've had for so long it's easy to get excited, but it does show some stability. Median price actually bottomed out in April. It's been bobbing around a little but July was up.

Ted Simons: It's still a foreclosure heavy market though, is it not?

Karl Guntermann: That's correct. That's correct. It's a very artificial market in that sense. There are a lot of foreclosures on the market. Lenders are holding a lot of properties, there will be more foreclosures, so that whole supply side is still very uncertain.

Ted Simons: I want to get back to lenders holding properties in a second here. But the first time buyers in a tax credit that they can take advantage of, are they taking advantage? Are you seeing signs of that out there?

Karl Guntermann: Oh, yeah. There's a good deal of evidence that that's been an important factor.

Ted Simons: How long is that tax credit going to be involved?

Karl Guntermann: It's set to expire December 1st and for the first time I'm hearing things about it being extended.

Ted Simons: Let's get back to the idea of lenders holding on to property that -- just the time frame it takes for a foreclosed sale to go through, critics are saying that this is all fine, that maybe the numbers aren't falling as fast as they were, but next year all you know what's going to break loose when this stuff is released on the market. Is that a valid criticism?

Karl Guntermann: Well, it is but I think it's really hard to say what's going to happen. There's just so much uncertainty. The economy is improving and to the extent the economy turns around, and interest rates remain fairly low, we may not see the foreclosures next year that are expected. So there's just too much uncertainty to say with any definiteness that prices are going to continue falling.

Ted Simons: And I bring this up because there was another report out there, a national report, that did mention Phoenix among the places hardest hit, saying home prices next year because of this flood and because of arms and different types of loaning mechanisms coming to term, that we could lose like 20 some odd percent even from where we are now. Does that make sense to you?

Karl Guntermann: One figure I saw was 17.3% which seems very precise to me for such an uncertain topic.

Ted Simons: It does.

Karl Guntermann: But yeah, there may very well be price declines. That's why I wouldn't get too excited about a 2% increase for a month. The market's just too unsettled and it's too hard to say, you know, it appears that we've bottomed out, but it's too hard to say prices are going to start going up and, you know, depending on what happens we very well could see another round of significant price declines next year.

Ted Simons: And to be clear, again, we're still prices are still declining just not so much.

Karl Guntermann: That's correct. Our index measures price changes from a year ago. And the July number was the prices are down 28% from July 2008. And that's an improvement from June which was 31 and September it's down to 23%. So that's still a significant annual decline.

Ted Simons: So it's like if you're sick and had 104 degree temperature it's now 101, good for you.

Karl Guntermann: That's right, and you know, given what we've been through for several years that's optimism.

Ted Simons: Yeah, better than -- O.K. I worry because of what we went through about investors, the investor who was out there and who was so responsible for a lot of what the market was, the bubble that we had, are we seeing a lot of investors buying now and does that concern you?

Karl Guntermann: Well, we are seeing a lot of investors, you know, the first time tax credits bringing out first time home buyers and there are a lot of investors. I guess I'm not as concerned about the investors as I was a few years ago, for the simple reason that the investors then were more flippers, they'd come in and buy it, take advantage of the appreciation and sell and get out. The investors that are coming in now, many of them are paying cash for the property, they understand the condition of the market. They understand this is a long-term investment in the sense of a number of years. At some point those properties will come on the market, so to that extent it is still an artificial market and will be for several years.

Ted Simons: Back to the median prices here, it sounds as if the lower priced homes are getting hit harder than the higher priced homes, correct?

Karl Guntermann: That's correct. We estimate the index for cities and regions, we started estimating it for the upper portion and the lower portion of the housing market and unfortunately for the lower priced houses the decline from July to July was 41%. Compared to 21% for higher priced houses.

Ted Simons: Why is that? What do you think's happening?

Karl Guntermann: That's where more of the foreclosures are, those properties were, you know, located further out, more marginal buyers, many cases of people who shouldn't have qualified for a loan. So there's just a lot more, you know, downward pressure there.

Ted Simons: Talk about the townhome and condo market, because that almost seems at times to be separate and apart from what's happening with single homes. First of all, is it separate and apart and secondly what's going on?

Karl Guntermann: Well, it is separate. It's a distinct segment of the market. There are people who prefer townhouse condo, patio home lifestyle. We started this month estimating an index more townhouse condo. It's data that was not included in our single family price index. So it's an entirely new set of data and entirely new index. And unlike single family housing, what we found was the townhouse condo prices from July to July were down 36%, which was actually an acceleration from 31% in June. So that segment of the market appears prices are still heading down.

Ted Simons: Yeah, so it's still 104 degree temperature on the condos and townhouses.

Karl Guntermann: That's a good way to put it.

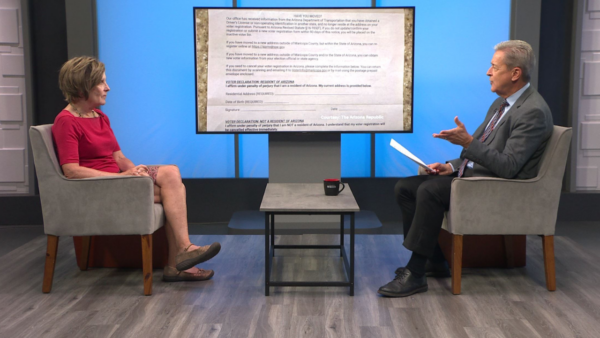

Ted Simons: Your repeat sales index that you use, it's different than what we see other housing experts and forecasters use. What's the difference and why is your way better do you think?

Karl Guntermann: Well, maybe to start off with an analogy, in retail they talk about same store sales, they compare same store sales from a year ago as a measure of what's happening to the company. We do that with house prices. We take, for example, all the sales that took place in July and we pair them up with previous sales of those same houses. Sometimes multiple sales and our data goes back to 1989. And we then calculate the rate of price change and through a very sophisticated statistical procedure we estimate an index and what I really report is the change in that index from the previous month and from a year ago.

Ted Simons: And other forecasters look at what?

Karl Guntermann: Well, the easiest way to do this kind of comparison is to take the median price which would be the midpoint price of all the houses that sell in July and compare that to a year ago or June. The problem with that and the error that gets introduced is that mix of houses is different every month. So you have bigger houses one month and another older, etc., so you're not really controlling for the quality of the houses.

Ted Simons: Bottom line from this last report, your headline would be what, would it be a positive headline? Would it be a cautious headline? What do we take from this?

Karl Guntermann: I would put a cautious headline in it, you know, the rate of decline peaked out last February and March, and that's shown pretty steady improvement. Median prices appear to have bottomed out and are moving up slightly, so I take those as positives but again I would be cautious, just because of the foreclosures, because of the investors in the market, and potential foreclosures next year.

Ted Simons: All right. Karl, good to have you here, thanks for joining us.

Karl Guntermann: My pleasure.

Karl Gunterman, Economist, Arizona State University;