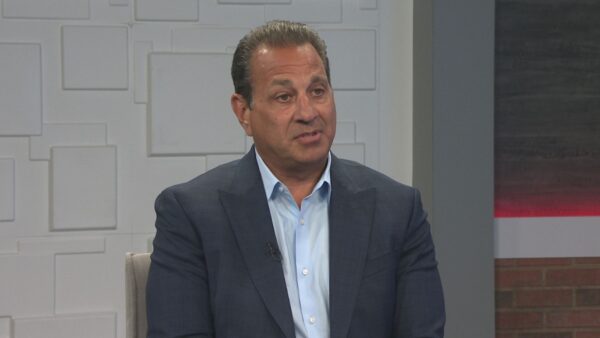

Bill Brunson of the Internal Revenue Service talks about changes in the tax code and other information to help you file your tax return. Also, Anthony Forschino of the

Arizona Department of Revenue will review the changes to state tax laws.

Ted Simons: The April 15th tax deadline is coming up. Every year, changes are made in tax laws at the state and federal levels. Here to give us a heads up on what we need to know are Bill Brunson of the internal revenue Service, and Anthony Forschino, of the Arizona department of revenue. Good to have you both on "Horizon."

Anthony Forschino: Thanks.

Ted Simons: Changes to the tax code, we need to know. What have you got?

Bill Brunson: I would say the first-time home buyer credit is big, because they've extended that item so that if an individual enters into a binding contract no later than April 30th and closes on the home no later than June 30th, they will have met the new extension time frame. Along with that law change with that first-time home buyer credit with that extension of time, is the long-time -- the first-time home buyer credit, the long-time resident credit, which allows an individual that currently owns a home has lived in the home five consecutive years out of the past eight, would qualify for credit as well. Both credits are refundable, you have to use a particular form, a 5405, and you have to attached that supported documentation to the form, which means this year you have to submit it on a paper return. You can compile electronically, but you're going to have to file that form with paper.

Ted Simons: I want to get back to those two especially. Such a long time, a lot of folks watching the program have been in their homes for more than five years. I want to get back to that in a second but as far as the state is concerned, what's new?

Anthony Forschino: There's not any real big new changes in the actual filing of the tax return. Big thing that is coming up, and it will affect what you end up paying or not, is the change in our withholding. What's going to happen is as you know for years, our withholdings was a percentage of the federal. So if you -- if on your paycheck had you $100 of federal withholding, and you took 20%, as your election, $20 went to the state. But what would happen is the state withholding, whenever the federal would change, so would the state. And so in this past year, the federal lowered their withholding, so did the Arizona go down, but it didn't change the tax for it, so you end up getting a lesser refund or have to pay more. So what we're going to do in the legislature is starting in July 1st, we will no longer be linked to the federal government, it will be our own tables. And we're going to release those hopefully in the next couple weeks.

Ted Simons: Who is working on that?

Anthony Forschino: We're hoping to have something out in the next few weeks. It will be more of a percentage of your gross income or your gross -- we're trying to figure that out, but we'll put those out.

Ted Simons: It's something that we'll be talking about next year.

Anthony Forschino: Exactly.

Ted Simons: OK. Let's get back to these home credits, the credits for the home buyers.

Bill Brunson: If you're in the market for buying a home this, is a good time. Your first-time home buyer credit, is worth $8,000. It's a refundable credit, which means it can cause a refund, increase a refund, or reduce a liability. The long-time resident owner means that you have a credit of $6500 that's refundable. You have to be in that home five years out of the past eight. If you lived in your home 20 years, you lived there five out of the last eight, would you qualify if you're going to buy a new home. But you have to meet those time frames. You have to enter into that binding contract by April 30th, and close no later than June 30th. You can claim it on your 2009 return, your 2010 return, you can file your 2009 firm and amend it. There's a lot of different options. All they have to do is call us or go to IRS.GOV, all that information is there.

Ted Simons: The earned income tax credit, talk to me about that.

Bill Brunson: It's been around since 1975. Congress put it in effect to offset social security wages -- social security taxes that people are paying. This is for people that don't make a lot of money, and it can put money into your pocket. It's a refundable credit, the maximum credit this year for the earned income tax credit is $5,657. That's a whopping piece of change. Average earned income tax credit last year for Arizonans was around $2,000. Now, folks have had some bad times lately, they've been laid off from work, less hours, even lost a job perhaps. Earlier years they may not have qualified for that earned income tax credit, but this year they may. So they don't want to guess, they want to find out. They can contact the IRS and we can tell them yes, you do qualify or no, you don't. But if you do qualify, you want to file and get that, because it's money in your pocket.

Ted Simons: OK. I want to get to electronic filing in a minute, but back to the department of revenue, we have been hearing that the budget cuts have met with staffing problems. I know this doesn't necessarily have to do with our forms. But what's going on?

Anthony Forschino: One of the things is a year ago, in February, we lost 300 people at the department of revenue. And majority of them were auditors and collectors. But in this last budget that just passed, the department of revenue has been at least allocated back some more collectors and more auditors to get them back on staff and start getting that going again.

Ted Simons: Encouragement there.

Anthony Forschino: Yes.

Ted Simons: OK. You talk about all these credits and all -- I got a form, you can't do this, but you've got to go here, and a lot of folks are filing electronically a lot of folks doing their own taxes. You got to be careful, don't you?

Bill Brunson: Well, there are tax scammers that want some of your money in their pocket. So you're right, the bottom line here is that if it sounds too good to be true it probably is. If somebody says, you know, I can help you get your refund, when the IRS may have already paid that you refund, but they're saying there's more money out there, and you get this unsolicited email in your inbox? Well, you don't want to click on the link, don't open that attachment. You want to stay the heck away of it. Send it to [email protected]. But the key is that they're going to want information from you that the internal revenue Service already has. They're going to want your social security number, they're going to want bank account information, so they can do you financial and I.D. theft harm. Don't fall for those items where they say, I've got money for you. If you feel you do have a refund coming, and you're not sure, call the IRS or stop by one of our offices. We'll review your account and go with it, go through the account with you and clarify whatever is out there.

Ted Simons: You mentioned being careful with scams. Electronic filing, I know it's increasing by leaps and bounds, but some folks seem to be still a little wary. Not quite sure it's going where it needs to go. What happens if you use tax software and you E-file, and the software messes something up? What happens?

Bill Brunson: If you're talking about somebody that makes an error based on information that they felt was good and correct, there's not going to be any major issue with that. The actual amount of tax that would have been due the system still has to be remitted, paid, and if there's any interest accruing on that amount, if it's a late payment, that would be required to be paid by law as well. But is there going to be any penalty assessment? No. The thing is, if you make an honest accounting mistake, whether it's a software error or something else where you expense something that you should have capitalized, whatever on the return, those things, those issues we work with all the time. It's when you want -- when you try to willfully defraud the federal government, that's where you have issues with the system.

Ted Simons: So if E-filing, you use tax software and the software was faulty, there are ways to figure that out.

Anthony Forschino: Right. And plus, a lot of times when the returns come through, there's going to be a math and data check anyway. If the software did some type of math and data error, we're going to check that before it gets processed.

Ted Simons: All things consider, still wiser to E-file?

Anthony Forschino: Yes.

Ted Simons: Agree?

Bill Brunson: Oh, yes. Definitely. And everybody here in Arizona can go to IRS.GOV, click on the "free file" icon and file for free at this point in time. And folks still have time to do that. Now, if you don't have all your paperwork together and you need a few more days, like six months, you can request an automatic extension to file. You can do that electronically by going to IRS.GOV.

Anthony Forschino: And currently with our refunds, it's -- it's an average of seven days with electronic filing, and almost four plus weeks if you pay for file -- paper file.

Ted Simons: Sold. Thanks, guys, appreciate it.

Anthony Forschino: Thank you, Ted.

Bill Brunson:Internal Revenue Service;Anthony Forschino:Arizona Department of Revenue;