Creative Media Investments (CMI) is a Phoenix company that invests in musical acts to help them reach commercial success. The company’s first project is the British alternative rock band “A Silent Film”, which wrote and recorded much of its new album in the Valley. Learn more about CMI from its co-founders Lee Evans and John Brand.

Ted Simons: Good evening, and welcome to "Arizona Horizon." I'm Ted Simons. Venture capitals and musician was seem to live in different worlds. One exists to make money, the other, to make music. But a local company created media investments is bringing together investors and artists to help fund and support promising creative talent that could, with the right kind of nurturing, show a successful return on investment. David Majure tells us more about this new way of supporting the arts.

Spencer Walker: The first time we went to the desert it was very inspiring for us. You've got space for ideas, and freedom of expression.

David Majure: British rock group a silent film celebrated the release of its new record with a free concert in downtown Phoenix. The band was thousands of miles from its home in England, but only minutes from the desert Hideaway where much of its music was born.

Karl Bareham: We ended up getting a house in cave creek. We put a makeshift studio in one of the rooms and we wrote maybe half the record there.

David Majure: The band lived there for the better part of 2011, and not just during the pleasant months.

Spencer Walker: The bad ones, when everyone said you should try summer. We are here for the summer, and they're like, they're never going to make it!

Karl Bareham: It's hot. It's a dry heat though, right? [laughter]

Karl Bareham: We wanted to find somewhere that was the exact opposite of what we were used to. Take ourselves out of that comfort zone of what we knew from Len don't.

David Majure: Cave creek, Arizona, was just the ticket. So a silent film settled into its strange new world in search ash advertise tick inspiration, and to be close to the Phoenix-based company that is supporting the band. Creative media investments is a venture capital company that invests in the careers of select artists. The company was cofounded by Lee Evans and john brand. They saw a business opportunity in a changing music industry where record labels no longer rule, and worldwide exposure is an internet upload away.

Karl Bareham: People need to start thinking in different ways to do this.

David Majure: CMI says what it's doing is different. It identifies talents, finds investors who support their careers, and provides the marketing expertise to help them succeed.

Spencer Walker: I hate talking about this in one way, because it comes across like ware business driven band, because we're actually not. It's in a weird way that's why this model suits us. It takes the business out of it. You don't have to worry about getting -- I don't know, getting shafted. I don't know if that's appropriate or whether that makes sense in America. You don't have to worry about people doing things that maybe you don't think they should be doing, and not having your best interests at heart.

David Majure: CMI filmed a partnership with a silent film by launching a limited liability company.

Karl Bareham: Everything is very independent. Us four guys, Lee and john working together as a team of six on this project.

David Majure: CMI says the band gets an above average share of profits, and retains ownership of its music and other intellectual property.

Spencer Walker: CMI basically gives us the chance to realize our dream of making music and owning and controlling what we are creating. ¶¶ And yes, being able to do it ourselves. But with some serious backing.

David Majure: It allows a silent film to tour extensively, introducing new audiences to its music. If all goes as planned, investors will someday see a return on their investments. But for now it's about the songs. And sharing them with all who will listen.

Spencer Walker: I think someone asked us the other day whether that album would have been different if it was recorded anywhere else. All of us immediately said, absolutely. For us to come from oxford and then throw ourselves into the opposite basically world that is Cave Creek, Arizona, that had a profound effect on the music.

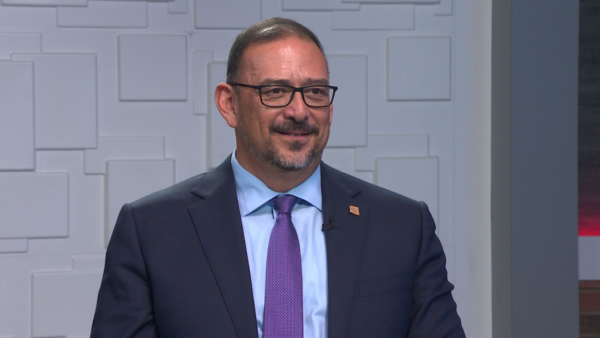

Ted Simons: Here to talk about their venture capital company and how it has investors betting a silent film is going to make serious noise in the music industry are the cofounders, Lee Evans who has a background in venture capital, and John Brand, a 35-year veteran of the music business. Good to have you both here. Thanks for joining us.

Lee Evans: Thank you.

Ted Simons: This is very interesting stuff. Venture capitalism for the arts, how did this idea get started?

Lee Evans: It's actually started when john and I met in Los Angeles back in '09, 2010. And we just started talking about the problems within the industry. John has a very long career in the music industry, and we spent, I don't know, over probably a couple days, but primarily one evening talking about the problems encountered, the way the industry is changing and so on and so forth. And then we looked at, how does that get fixed? And we started putting the pieces together, and within a short space of time we've come up with a plan on how we could put a model together to fix the problem and make it -- musicians successful.

Ted Simons: What were some of those problems that were initially discussed?

John Brand: Well, the industry has been changing for the last 10 years, really. The independent labels started way back in the '70s, and the -- over the last 20, 30 years, the independent labels have been bought up by the majors, and the majors have had their own sets of problems, and they're now down to three nearly -- four, nearly three. And it seems to met artists get signed, they get one shot, and if don't achieve the sales figures the majors need to turn a profit, they get dropped and left behind. And many of those artists obviously they built a fan base during that time and many have the opportunity to move forward and have careers. But they're not given that opportunity by the major labels. So we identified two things, really. One is finding new artists to back a silent film -- like a silent film, but mostly giving artist who's have been in that situation, who have come out of contract for one reason or another, have already built a fan base and given us the opportunity to understand the potential of that band.

Ted Simons: I was going to say, what kind of artists are you looking for here? Is it a solo artist, obviously other intellectual property is involved, filmmakers, writers, young untested, slightly proven? Veterans who have been around the block a couple times? What are you looking for?

Lee Evans: The model that CMI has, you can build any of those into the model. Primarily partially tested would be great. Because it gives us something to analyze and see if we could multiply that. In terms of particular artists, it's across the board. We've got some primarily most have been British acts we've looked at. We do have some American alternative acts, we looked at an American idol runner-up, and last week we looked at a local pianist who has an interest in doing corporate entertainment as opposed to mainstream pop and rock soissments. So it's really across the board.

Ted Simons: How does this work? Let's say -- first of all, you find someone. Say the pianist, someone. Who says, I like that person, and how many other people have to be convinced that that person is good enough to be an investment?

Lee Evans: As many as possible.

John Brand: We have to like it. But more than that, we need to see that the artist has potential. So we have teams of people that we work with over the years, and we formed a relationship with a company in New York who -- it's run by two guys who are very experienced, and they help us with marketing and they help us with a lot of the decisions that need to be done. And they basically we -- if somebody comes to us with an artist, we will approach the marketing companies that we work with and do our due diligence. We'll figure out realistically what the potential is of that artist, and how many people actually like them. Will most artists have already released records, there's quite a lot of information available from radio play and sales figure and concert tickets and what have you. It's quite easy to get a pretty accurate accept of where they're going. Then you've got to look at the music that they're bringing us. Part of our model is that we will -- we'd like to look at finished product as opposed to investing in the artist. In the beginning we'd see ourselves as investing in the records. So the artists will bring a finished record, so we look at the marketing potential of that.

Ted Simons: What if you have a young Neil young who wants to put out a different kind of record, wants to become a different kind of artist every five years, reinvent themselves. How do you get past that, and B, how do you convince investors this is the world of art? That he who paints a pretty picture over here may be entirely unrepresented -- you know what I'm trying to say?

Lee Evans: I do. Unfortunately at that point we would probably pass on an artist like that because we are responsible for giving a return on the investment. So we couldn't sort of squander on something which is such a gamble. A lot of when we do is reducing the risk, which is why partially tested artists are great because you've got something to analyze to project where you can take it forward.

Ted Simons: How do you approach investors? What do you tell them?

Lee Evans: This are time lines which are a lot better than other investments available. We can look between nine months and two years to see a return. We don't have a lot of government red tape to go through with this particular industry where others do. We only invest into a finished product, so the long haul of making the album, which can be a year, 18 months, two years, that's eliminated. So we've taken that chunk of time out, and you have two years before they see a return on their investment.

Ted Simons: As far as ownership equity is concerned, what do I get when I invest, how long do I get that?

Lee Evans: There's a present arrangement we have for three albums with particular artists. So that is not a set space of time. And then there are options to reup that deal at the end of the three albums.

Ted Simons: So -- but again, as far as the rights of the band, the musicians in this case, the artists, the writer, the filmmaker, they keep rights for their property? How does that work?

John Brand: They actually sign their rights to the LLC. So the band is a percentage owner of the LCC, the investor is a percentage owner, as is CMI. The three parties come together to form a company, the band assign their rights, we invest their money, and then we put together the project, put it together a marketing plan and launch the project.

Ted Simons: If everyone wants to reup they go ahead and do that.

John Brand: Yep.

Ted Simons: Is it difficult to get bands to not just understand all this, but to see this -- even in the package, I think the drummer was saying it's difficult to think of this as a business. These are artists. They're not supposed to worry about money.

Lee Evans: That's true. For the most part 10 'tises tend to be artists. This particular band, very smart guys, well educated University graduates. So they do understand it. I've known these guys for seven years, and I've been manage can them for three years. So when I first discussed the idea with Lee and I knew the position the band was in, I knew this was actually a band who would understand the model. For the most part it's down to having discussions with the artists' managers. It's got to be -- the manager is a very much part of the team. And the manager needs to understand that this is a different way of doing things, and they come to us because they know of the advantages. We offer up much higher rate of return to the artist than the labels would ever give more than double in fact.

Ted Simons: I was going to say, this seems like the old days it was the label, it was the creative guys,. And &R guys trying to find these things, then you've got the management, all this stuff, it seems like it's all rolled into one here.

Lee Evans: It is.

Ted Simons: And that's got to be -- I would think it would take some pressure off the band, but is there also other pressure on the artists, they've got to deliver.

Lee Evans: Well, they do, but before they are selected, they pretty much have delivered because we've been looking at an almost finished product. So we just look at the unit of the band and -- because they've got to commit to a lot of touring and hard work. But the product, the album is very, very close to finished before we start spending money on it.

Ted Simons: Is this the kind of thing that is best suited for music as opposed to maybe fine arts, film making, writing?

John Brand: We believe the model can work with everyone. We've been looking at different areas, certainly film making is very much based around this model anyway. You've got investors invest nothing a money which tends to be an LLC entity anyway. So our investors would invest in much the same way as they would normally do. The difference between what we do from a film point of view is that we try to use art departments and musicians, and filmmakers and put the little team so when the film is being made, we have our music. We have the creative people involved, and the film making process. And vice versa.

Ted Simons: Keep it all in the family.

John Brand: Which offers opportunities to the various companies.

Ted Simons: Real quickly, as far as those investing so far, who you're targeting, who you're getting, are these angel investors, corporations? Venture cap lists?

Lee Evans: So far they've been individuals. It's been primarily from Europe. So we've been bringing European investment into here in Arizona. We would always look at anybody that is interested in diversifying their portfolio. It's not a model that's widespread or it's relatively new. So we would look at angel investors and anybody that's looking to diversify or just change from the same old investments they've been doing.

Ted Simons: About 10 seconds left.

John Brand: Recognizing the rate of return is much quicker than the average investment.

Ted Simons: All right. Good stuff. We'll stop it there. Thank you both for joining us.

Guests: Thanks very much.

Ted Simons: Thank you.

Lee Evans:Co-founder, Creative Media Investments (CMI); John Brand:Co-founder, Creative Media Investments (CMI);