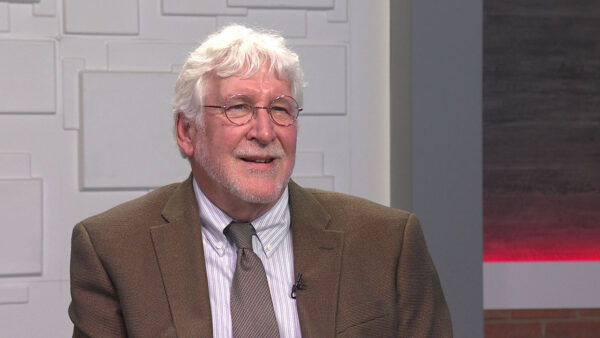

The housing market in the Phoenix area has returned to normal historic levels for foreclosures. Also, prices are up 26 percent. Mike Orr, director of the Center for Real Estate Theory and Practice at the W. P. Carey School of Business at Arizona State University, will bring us up to date on the Phoenix-area housing market.

Ted Simons: Good evening, and welcome to "Arizona Horizon." I'm Ted Simons. Foreclosure levels in the valley are back to normal, historic levels. That sounds encouraging, but what does it mean for the valley's overall housing market? For answers we turn to Mike Orr, director of the center for real estate theory and practice at ASU's W.P. Carey School of Business. OK, normal historical foreclosure levels. What's normal?

Mike Orr: Well, I've been tracking foreclosure numbers going back to 1996. So I've got a view of what's normal, and foreclosures never disappear. There's always some. You can see during normal times there's a pattern. The last time we had a normal market was back in 2001, 2002 era. And what I'm seeing is we're getting new foreclosure stats back down to the same sort of level as we were then. When you allow for the population growth, there's been since then, we should have more. So I think it's fair to say that the foreclosure stats are definitely back to normal.

Ted Simons: Foreclosures down 57% I think year to year --

Mike Orr: Yep.

Ted Simons: And the starts are down 67%.

Mike Orr: Continuing to go down each month is lower than the month before.

Ted Simons: OK. So explain what a foreclosure start is.

Mike Orr: Well, when someone gets delinquent on their mortgage, the banks usually send them some letters to remind them, and eventually they say OK, we've reminded you, now we need to give you a formal notice, a notice of trustee sale in Arizona. We don't actually have true foreclosures, which involve going to court. We have trustee sales. And that formal notice is sent out, and it warns the person that the trustee has the right to sell their house in 91 days after the notice. So that's really the start of the foreclosure process. And during that 91 days the -- Various things can happen. The homeowner can catch up, they can sell their house and pay off the loan with the proceeds, they can do a short sale, if the sale won't actually satisfy the debt, but the bank agrees to take that lower amount of money, or they can deed the home back to the bank, like a cooperative foreclosure, it's called a deed in lieu of foreclosure, but most usually what happens is the trustee sells the home by auction. That's the end of the foreclosure process.

Ted Simons: Foreclosure starts down 67%, foreclosures down 57%. And you're saying that this will continue, this trend could continue?

Mike Orr: I think we'll go below normal in the not too distant future. Probably before the end of the year, actually, because most of the foreclosures we've had in the last six years, and we've had a fairly large number, have been on loans written during a problem period where the lenders were extremely free with their money. But since 2008, they've been very tight. The lending restrictions have been -- They've only lent to people with very good credit, they've required very large down payments, and most of the homes we've bought since that period have gone up in value. So there's no negative equity. So those are going delinquent at an abnormally low rate compared to the abnormally high rate we saw earlier.

Ted Simons: What is the impact on the market overall with these fewer foreclosures?

Mike Orr: We've got fewer distressed homes coming on to the market. Most of the listings you see on the local MLS are normal sales by people who don't have to ask the bank's permission, and therefore not going to take anything less than full market value. So it means buyers are no longer in charge of the market, it's really a seller's market.

Ted Simons: Fewer homes, higher prices?

Mike Orr: Yes. And we've probably got that condition going to last for quite some time now. And that's because builders built so few homes over the last four or five years.

Ted Simons: Are they waiting for some magic signal, or are they just so burned from the last go-around they're really --

Mike Orr: I don't think they need a magic signal. They can see homes are needed, but they can't necessarily ramp up overnight. Building a home first of all you've got to have the land, the land has got to have all the facilities there, they're snapping up those sort of finished lots that were left unfinished, un-built on, but many of those have gone now, and to create a new subdivision from a fresh piece of desert or fresh farmland, that takes quite a long time. And even if they've got that, we're a little short of qualified labor to build twice as many homes.

Ted Simons: Interesting. Interesting. Investors. Last time we talked it sounded like they were starting to lose a little bit of interest. Are they still losing interest in Phoenix?

Mike Orr: It's stabilized. They were peaking July last year, it's gone down quite a bit since then over the last two or three months it's been around same level. A few people have moved away, it's still very much focused on the people buying to rent, not buying to flip. So the investors are those people who see a long-term improvement in the market, and therefore they think it will be a pretty good appreciation over the next five years, and the great thing about being a landlord is the tenant comes in and pays all your expenses and you get to keep the asset. So you kind of win both ways.

Ted Simons: Are these institutional investors we're talking about here, or the mom and pops?

Mike Orr: Mostly mom and pops. There's been a lot of fuss about institutional investors, because they're new, institutions never used to invest in single-family homes. Because it's new it's gotten a lot of attention from the media, but for every institutional investment home there's another 19 homes bought by mom and pop investors the traditional way. Just local people who decide to invest, make it their IRA or spare money that they're saving in real estate as they think that's a safer way to put it place to put it than maybe the stock market or a savings account.

Ted Simons: You mentioned earlier that banks, people are wondering whether they're going to tighten, loosen regulations. Interest rates seem to be moving a little bit. Where are they moving and what is that doing?

Mike Orr: They've moved quite a lot. I guess from around 3.5 to about 4.5 in a pretty short time. So that sent shock waves through the financial industry. There's two schools of thought about what that can do to housing. People will say it makes it less affordable, so the demand will go down. And those who say oh, no, that's going to get lots of people who are wavering off the fence thinking I better go now because it's only going to go up more. And I think both are true. You're going to see a few people drop out, but you're going to see a few other who's decide to come in. And overall I don't think it's going to have a huge effect on demand, because really the market isn't controlled by demand. It's controlled by the lack of supply. That's the thing that's really pushing the prices up, not changes in demand, it's the fact we've got so few homes to buy right now.

Ted Simons: Real quickly, as far as the weather impacting home buying season, it really does make a difference.

Mike Orr: It's the very significant difference. You see it on all my charts. By the time we get to June, there's definitely a falloff in interest, which stays down until we get to -- When temperatures go below 100 I say AH, the buyers will be coming back. The snow birds.

Ted Simons: Do you see any major changes in trends when the weather starts to cool?

Mike Orr: I think we're going to go back to the short supply, dominating the market and priceless still have to move up. We're going to have to have prices moving up until they're so high that most a-- More supply will come in.

Ted Simons: Interesting stuff. Always a pleasure. Good to have you here.

Mike Orr: Thank you very much.

Mike Orr:Director of the Center for Real Estate Theory and Practice, W. P. Carey School of Business at ASU;