Empty office space could lead to the next economic crisis

Aug. 2, 2023

Empty office space could lead to the next economic crisis. Office buildings remain empty in cities across the U.S. as many workers continue to work from home more than three years after the pandemic began. A large number of workers may never return to the office full-time, raising questions about the future of some buildings, and raising the prospect of a financial meltdown.

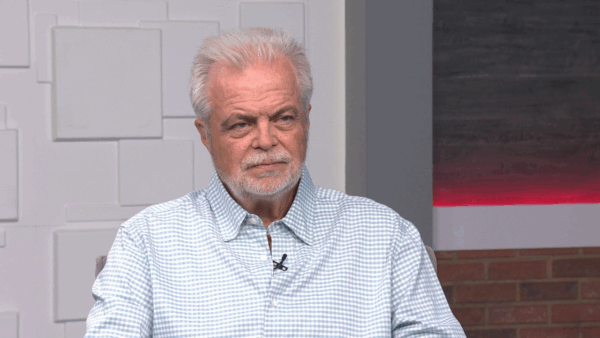

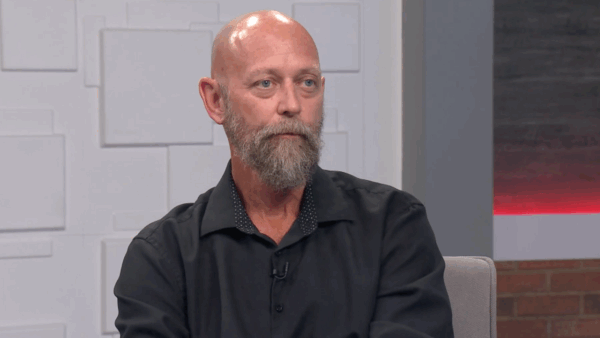

Mark Stapp, the Fred E. Taylor Professor of Real Estate and Executive Director of Real Estate Programs at the W. P. Carey School of Business at ASU, discussed what this empty office space could mean.

How common is this emptiness?

“It’s very common. The pandemic had an effect on commercial space in general and a really profound effect on all office space in particular. This came at a time when technology was converging with changing behavior. So even before the pandemic, we were reducing the amount of square footage that we needed per employee,” Stapp said.

Technology amidst the pandemic allowed people to have that remote working environment, which propelled this big change, according to Stapp.

What will happen to empty office spaces?

“Some of it depends. Not all office space is suffering,” Stapp said. It’s a problem for some of the older office spaces, and, for big office markets like San Fransisco, New York or Chicago, it could cause serious damage.

However, it’s a problem for anyone who owns an office space because lenders need to be repaid. When occupancy is not the same, value is lost, Stapp said.

Will this greatly impact the economy?

“I don’t think it’s a disaster. The reason I say that is lenders don’t want these back, because if they take them back, what do they do with them? It’s not like they’re going to go sell them into the marketplace if there’s no demand for them. So what I think is likely going to happen is you’re going to see more workouts. We learned from the pandemic, lenders learned from the pandemic, that simply enforcing your rights to take the property back doesn’t necessarily result in a good outcome,” Stapp said.

We will also see a lot of private capital looking at these assets and purchasing them for below replacement costs, according to Stapp.

“Some of them will be purchased, some of them will be worked out, some of them will just be obsolete,” Stapp said.