Elder financial abuse on the rise

Aug. 7, 2024

Every year, approximately 1 in 10 Americans over the age of 60 report experiencing some form of abuse.

In 2023, over 101,000 reports of elder financial abuse flooded the FBI. This shed light on a distressing reality: abuse can strike anywhere, by anyone, often concealed by fear.

The financial consequences are staggering, with victims facing losses estimated at over $36 billion annually.

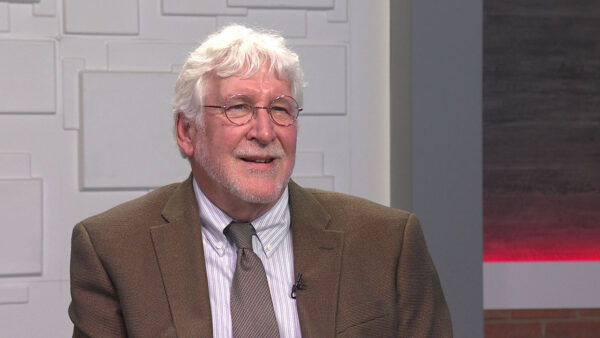

Rachel Caballero, Community Development and PR manager at TruWest Credit Union, joined us to discuss investment scams, tech scams, data breaches, romance scams and nonpayment scams.

“Essentially with financial abuse, it’s anybody that takes control of your finances in any aspect that doesn’t have business to be doing that,” said Caballero. “It’s happening a lot with our aging elders, the 60-year-old age range is the most susceptible to have it happen.”

Most people are not able to recognize the signs of financial abuse, especially in older adults. Due to elders being left in the care of a family member, signs of financial abuse are harder to identify.

“As technology increases, the scams increase,” said Caballero. “People are getting desperate to pry on the vulnerable; with elder abuse, it happens as people lose mobility and cognitive ability.”

Technology is one of the biggest components of financial scams among the elderly population. As cognitive ability declines along with a lack of knowledge about technology, scams are likely to occur.

Caregivers should report to the Adult Protective Services if they spot suspicious activities.