The days of flipping houses has passed, but now there’s a new concern: flopping. Arizona real estate reporter Catherine Reagor explains how investors are using this strategy to take advantage of a depressed housing market.

Ted Simons:

The days of flipping houses may have passed, but now there's a new concern. Flopping. It's a strategy used by investors to take advantage of a depressed housing market. Here to explain how it works is Catherine Reagor, real estate reporter for "The Arizona Republic." Thanks for joining us what is flopping?

Catherine Reagor:

It's revolves around short sales. Big underwater, like Jim said, are trying to sell and where the lender agrees to take less money than what's owed. A short sale. 20,000 in the metro Phoenix. A lot. These flop scams, what a group does is convince a lender to take less than what the house might be listed for and if the house was listed for $200,000. But $250,000 was owed. They might convince the lender to take $150,000. The market is really depressed and the lender agrees and they turn around and flop it for $280,000 because that's what the market would pay.

Ted Simons:

You've got a house for sale for $200,000. You owe $250,000. I'm an agent and say, listen, let's get $150,000 out of this thing and call it a day. You'll be free, the bank says fine. But unbeknownst to you and the bank, I'm trying to sell you at $150,000 meanwhile I've got a buyer for $180,000?

Catherine Reagor:

Yes. And there are real estate agents who may not be aware. Because of what it does to the comps and there are sophisticated groups doing this and there's so much going on, the regulation is tough to catch something like this, but sometimes they'll do it within days. Have both deals signed up. The lender doesn't know about the second deal and that's essentially defrauding the lender because the lender is supposed to get the most for the loan. If everyone signs off, then the lender is defrauded.

Ted Simons:

You mentioned 20,000 of these deals.

Catherine Reagor:

Short sales.

Ted Simons:

How common is this particular flopping? Not that you can figure out who is doing it.

Catherine Reagor:

At least 5% of all sales in the past year are doing this. And the FBI is targeting it, national group said it could cost lenders up to $50 billion this year. Nationally. Regulators here locally are looking at it. It not only defrauds the bank, it hurts the homeowner. And hits their credit record and if it sells for less that they could get, they can owe more to the lender and owe more in taxes.

Ted Simons:

Lets play devils advocate, hey, I've got your house sold, hey, I got this guy into a house, a couple of sales, as an agent, I've got two transactions and not that ethical there. But we've got things moving, and buying and selling and moving forward.

Catherine Reagor:

And if you're a homeowner and struggling and many homeowners aren't aware of what's going on. Great, I'll get the deal and the lender agreed. They're not sure of the ramifications but it skews the comps and sales because it's two sales for one sale and the house would sell for more. And in some cases, buyers would take more but sometimes their offers aren't getting taken. So that middle profit --

Ted Simons:

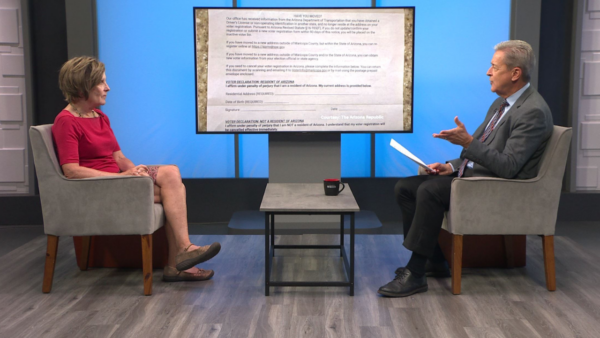

You wrote about how some agents are escalating the asking price, knowing no one is going to go for that deal.

Ted Simons:

They're lowering it, in some cases. Keeping it high and knowing that no one will buy it and then along comes -- they're able to convince the lender, I'm going to lower it for $50,000, the buyer comes in and purchases it, the lender is out of the deal and then they flop it for more money. Now, many market watchers, lenders, real estate agents and title agency people are very angry about this because of what it does to the market and in some case, title agencies were presented both deals and they have many -- many firms start rejecting them because there's so much concern over them. And Fannie Mae and Freddie Mac say if you do a short sale, the property can't flip for so many days. And how they regulate that, I don't know.

Ted Simons:

Isn't it against the law to conceal information from a lender?

Catherine Reagor:

It's bank fraud and unfortunately, right now, there's not a lot of sympathy for the lenders in some cases and you think, well, it's going to hurt the lender, but it does, and those are losses that come back to the taxpayer. Federally backed loans and the bank bailout and that's what is making some angry, the bigger implication.

Ted Simons:

The government-backed loans. What's being done about this?

Catherine Reagor:

Nationally, the FBI, I know they're looking into -- and other federal regulators, they've come and talk to specific firms and the Arizona association of Realtors, Judy Lowe, is very concerned because she doesn't regulate -- but when you're a real estate agent and sign on to a homeowner to get the best deal, it's ethical and if that hurts the ethics and the industry, that's an issue. And you know, other -- attorney general, very cognizant of this and looking into it because we don't need anything else working to hurt the housing market right now.

Ted Simons:

Right, right.

Catherine Reagor:

And fraud, you know, with what we're dealing with the fraud cases coming out from five years ago, more issues of fraud, mess up the market.

Ted Simons:

It sounds like something that real estate agents themselves will have to do a better job in terms of self-policing, if not just plain ratting on other agents when they know this is going on. Is that asking too much of the folks?

Catherine Reagor:

Arizona has great real estate agents and they're strong and care about the consumer and will do that. There are out-of-state groups doing it. They're very sophisticated and know how to -- and in some case, soliciting real estate agents. Bring me a short sale, we can make this work with an investor. It's shine can the light on it and saying it's illegal. You didn't realize it's defrauding banks and people stop.

Ted Simons:

Thanks for joining us.

Catherine Reagor:

Thanks.

Catherine Reagor:Arizona Republic;