A bill is being considered in the state legislature that would eliminate the transaction tax on residential rental properties, both homes and apartments. Opponents of the bill say it would be a loss of $87 million annually to towns and cities. Representative Darin Mitchell, the sponsor of the bill, will discuss the measure along with Chandler Mayor Jay Tibshraeny, who opposes the legislation.

Ted Simons: Good evening, and welcome to "Arizona Horizon," I'm Ted Simons. A bill being considered in the state legislature eliminates the transaction tax on residential rental properties which proponents say would lower rental rates. Those against the idea say it would result in devastating hits to municipal general funds. With us is the sponsor of the bill, Darin Mitchell, and Jay Tibshraeny who opposes the bill.

Ted Simons: This rental transaction tax, what exactly does it do?

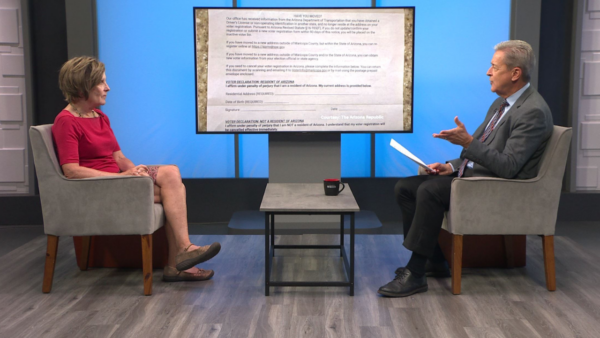

Darin Mitchell: The bill eliminates the ability of cities to charge a residential rental tax. Right now about 70 of the 92 cities in the state charge it, they have done it for 20 or 25 years. This will seek to eliminate that ability to do so.

Ted Simons: Why is the bill necessary?

Darin Mitchell: We've been looking -- I hear stories in the legislature all the time, we need to help people in need. We need to play fair. Taxes should be transparent and level. This is one of those taxes that are levied by some cities, not by all. It hits those -- it just happens to be the renters on average earn about half as much as homeowners. It targets folks who earn less money. Maybe they are young folks starting out or retirees or anyone else in the working poor, and they are targeted with this tax.

Ted Simons: Lower income folks being targeted with this tax, do you agree?

Jay Tibshraeny: That's a misnomer. It's tax on all residential rentals. Yesterday it's planned to do a project in Chandler, their rent is $1,000 to $2,000 a month. That's a rent that's typical in Chandler. It's really not aimed at helping the working poor. It's a special interests tax break pushed by the multifamily association. And that's why it's not really for the poor. And that particular bill, this bill as it's written will cost the cities and towns throughout the state of Arizona about $87 million a year as we speak. That's general fund money, that's how we pay for police and fire and libraries and park maintenance and what have you. So it's a critical hit to the cities' budgets and rightly so, we're very concerned about that kind of hit when we're just coming out of what was a really deep recession for all of us.

Ted Simons: Respond to the idea that's a misnomer.

Darin Mitchell: I hear it all the time, it's just not the case. It may be the average rent in Chandler, but you're not looking at the income of the folks living there. 35% of the households in the state of Arizona rent. I think it's $32,000 for the median annual income. $64,000 is the median income for homeowners in Arizona. It is hitting those who make less money.

Ted Simons: It is hitting them if the landlords choose to pass that on to the tax to the renters. With this bill is there then a guarantee that the landlords would cut the rental rates.

Darin Mitchell: Two things, number one, if you have a lease right now -- say this law went into effect tomorrow, your lease would take $1,000 a month, and your tax is another line item. You pay the lease amount, not the lease plus the tax. I did have a question about this. I wrote an amendment that said any savings from the enactment of this bill must pass through to the renter. I think we're covered on that.

Jay Tibshraeny: Even if you do put that into the bill, maybe they can do it for one lease term but they will absorb that, charge the higher rent and won't give them a credit for what was sales tax. I'm not going to buy that. I'm not going to buy that. Two of your votes last week tells me you weren't really looking out for the working poor then, the flex loan bill, one of the most onerous and financially speaking --

Darin Mitchell: If we are going to wider the argument I want to have time to discuss these.

Jay Tibshraeny: You're talking about this is for the poor and your vote on the flex loan bill, sometimes 216% in interest and fees. And the TANF, the temporary assistance for the working poor, went to helping children and families. I can't buy that it's for the working poor when the votes last week don't correspond to that.

Darin Mitchell: I'm talking about people being allowed to keep their own money. I'm not talking about government programs that hand out money to people. I'm talking about the working poor being able to keep the $40 a month so they can spend it. It goes to revenue shared for the cities anyway. My vote for the flex loans is because I think those people who need that ought to have that option. It's not up to us to decide they don't have the option.

Jay Tibshraeny: That's another bill that's pushed by special interest, the payday loan bill, and would be devastating to those folks.

Darin Mitchell: This bill was my bill, yes, don't argue with me on this. You don't know. I was researching this bill before anyone else came to me with it. It happens to be that the multifamily association also liked the bill, but this was my bill.

Ted Simons: Critics will point out you are a former contractor, correct?

Darin Mitchell: I am.

Ted Simons: You built apartments and homes.

Darin Mitchell: I built homes.

Ted Simons: Do you see any question regarding that association?

Darin Mitchell: I didn't build rental homes, I built custom homes.

Ted Simons: You understand the criticism and the question from those who see that association?

Darin Mitchell: I've been asked by those who oppose it, do I own rentals. I do not, I do not see any double interest there.

Ted Simons: The idea that this could be double taxation, these property owners they are already paying property taxes and now this rental tax is on top of that and there could even be corporate taxes on top of that. Do you see that as a factor here?

Jay Tibshraeny: I see that as a hypocritical argument. Retail stores pay property taxes and have to charge sales tax on the products they sell, so why not them? That's just another argument to get away from the real issue, which is that this is a special interests tax break for an industry that's already gotten special interests on this very same issue. Four years ago they got it into the legislation that to have this tax you have to have a vote of the people, which okay. To raise this tax in your community you have to have a vote of the people. All nine other sales taxes don't have those same rules. They have been down at the trough time and time again. It may have been your idea but for 15 years they have been trying to get this bill.

Darin Mitchell: 48 other states don't allow this. Only Arizona and Alaska allow cities to do this. There's a reason for it, it's the reason I'm saying. As far as nine other issues on motives, I think the first thing we hear from the cities, we're going to cut police and fire. Maybe we ought to look at the cities' budgets and cut the $86 million new city hall or public art projects in Tempe or the new light-rail in Phoenix or whatever. In your town we have a $2 million tunnel in Litchfield Park. Maybe some of these need to be looked at and the priorities the people need to be focused on what the city can make and spend with actual revenue rather than going after little subgroups and going after more revenue.

Jay Tibshraeny: This is a direct hit to our general fund. Police and fire in our city account for 50% of our general fund so. I don't think -- again, I think it's disingenuous to say it's not going to affect police and fire when you take $5 million out of my city's general fund.

Ted Simons: Fountain Hills, Maricopa, they don't have industry and retail there, these are bedroom communities who need this rental tax to keep police and fire going.

Darin Mitchell: A lot of cities are getting along without it. Big and little cities are getting along without this tax. I think we should look at what they are doing. I did a five year phase-in and for those little towns it was a 15-year phase-in. It doesn't take affect for ten years and then it's phased in over the next five. So we have plenty of time to grow the economy and look at other sources of revenue or cutting expenditures, but it's a long ways out. It's a little disingenuous to say if this bill takes effect, we're going to cut fire and police and it's going to be unsafe in the cities.

Ted Simons: Disingenuous.

Jay Tibshraeny: The only people being disingenuous on this particular thing are on that side of the table. You haven't explained because of special interests tax break. It's for the multifamily association building thousands and thousands of units and they continue to build them. This is not an issue, but they want to put that money in their pockets.

Darin Mitchell: I think, you know, I'm chairman of Ways and Means, that's all we deal with are tax policy for the state. When we look at tax policy we want fairness, transparency and to keep taxes as low as possible. This tax targets a certain segment of society. You should get rid of this tax and if you can't make it in your budget then you need to raise your sales tax. To do that you have to go to the vote, to the public. They are going to say whether it's capital improvements or otherwise, let's look at our pension plans or whatever it is that's spending our money, and figure out what those priorities should be rather than going after a certain segment of society.

Jay Tibshraeny: A couple of things there, the pension plans, you guys are the ones that have to make the changes to the pension plans. The cities are stuck with what's been passed legislatively. If you guys want to make some change you should do it we would welcome it.

Darin Mitchell: We would like your support in that.

Jay Tibshraeny: Well, you have to talk to us.

Darin Mitchell: Absolutely.

Ted Simons: That's a good place to stop. Gentlemen, good discussion, good to have you both here. Thanks for joining us.

Darin Mitchell: Thank you.

Darin Mitchell:State Representative, Arizona; Jay Tibshraeny:Mayor, Chandler;