What you should know about financial planning for retirement

Sept. 14, 2023

Many Americans want to plan for their future, but how do you start when you have no idea how long you’ll live? Factors like age can affect how you handle investments, 401Ks, IRAs and more.

It is also important to consider the kind of life you want to live in retirement: considering things like travel, a second home and medical expenses.

On average, men live to age 84 and women live to 87. Most Americans admit they have no idea what to do. Longevity literacy, or knowledge about life expectancies, is a new concept that we need to understand as we age so we can live our best life possible, financially.

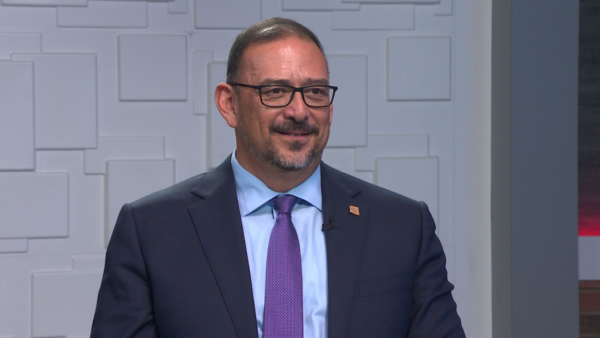

Jacob Gold, a certified financial planner and faculty associate at ASU’s W. P. Carey School of Business, joined Arizona Horizon to explain how best to financially plan for retirement.

According to a report by the TIAA Institute and the George Washington University School of Business, only 12% of U.S. adults have strong longevity literacy while 31% have weak longevity literacy.

“Many people don’t have an idea of how long they can possibly be living after retirement, they are in survival mode on how to get throughout the day,” Gold said.

Individuals should study their social security statement and recognize the appropriate time to start collecting.

“From a normal retirement age to age seventy, your social security benefit actually compounds by 8% per year,” Gold said.

Gold often says there are three stages of retirement: the go-go years, the slow-go years, and the no-go years, many people don’t enjoy their retirement as much as they possibly could because they don’t know how long they are going to live.