Arizona state budget concerns

Oct. 26, 2023

The Joint Legislative Budget Committee identified deficits for Arizona’s future state budgets approaching half a billion dollars. So what happened?

According to research done by the Grand Canyon Institute (GCI), the problem lies with the flat tax. Lawmakers in their 2021 session during the Ducey Administration decided to dramatically lower income tax rates for wealthy people.

According to GCI research, 70% of the total value of the tax cut benefitted those with incomes of more than $200,000. Less than 10% went to the vast majority of Arizonans, who earn less than $100,000.

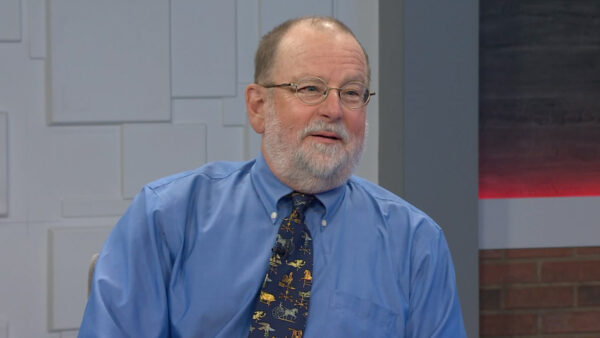

Dave Wells, Ph.D., Research Director at GCI, joined Arizona Horizon to discuss the state budget.

“I’m not surprised,” Wells said. “I’m very disappointed that we’re already facing such a horrible situation.”

Wells explained that low-income people paid a marginal tax rate that was about half of what high-income people paid. The legislature lowered the tax rate to what the lower-income people paid. This means that higher-income people are now paying 2.5% instead of 4.5%, saving some up to $200,000 a year. According to Wells, some of these people make over $5 million a year.

The Grand Canyon Institute, a 501(c)(3) nonprofit organization, is a centrist think tank led by a bipartisan group of former state lawmakers, economists, community leaders, and academicians. GCI serves as an independent voice reflecting a pragmatic approach to addressing economic, fiscal, budgetary and taxation issues confronting Arizona.