U.S. DEA moves to downgrade marijuana’s drug classification

May 7

The U.S. Drug Enforcement Administration (DEA) is moving to ease marijuana restrictions in the U.S. The DEA’s proposal, which still must be reviewed by the White House Office of Management and Budget, would recognize the medical uses of cannabis and acknowledge it has less potential for abuse.

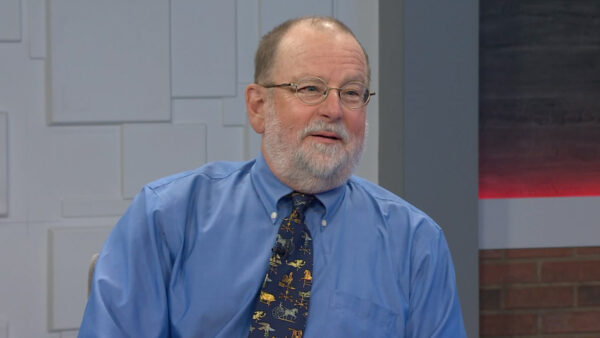

Will Humble, Executive Director of the Arizona Public Health Association, joined “Arizona Horizon” to discuss why this is happening and what it means.

Experts claim it would open more opportunities for cannabis research and cannabis industry advertising and promotion. It may reduce the approximate 70% or more tax rate that state-run cannabis companies average when they currently pay taxes to the federal government.

“A long time coming, in my opinion. Should have happened a long time ago,” Humble said. “The Controlled Substances Act passed in 1970, and it charged the DEA with classifying drugs depending on their possible medical use but also on their potential for abuse and dependency.”

Marijuana will be reclassified, changing it from the “Schedule I” group to the less tightly regulated “Schedule III.” For perspective, Schedule I put it on par, legally, with heroin, LSD, quaaludes and ecstasy, among others. Schedule III includes anabolic steroids and some acetaminophen-codeine combinations.

“The practical impact would be that you can start doing research with it,” Humble said. “At Schedule I, they say ‘no medical use,’ which means if you’re trying to do research, you’re not even allowed to administer the drug to your cohort in a clinical trial because it’s Schedule I.”

Humble explained under the federal tax code, businesses involved with marijuana or any other Schedule I or II drug can’t deduct rent, payroll or various other expenses that other businesses can write off.

“They should be happy once it’s done and moved to Schedule III, because right now, being a Schedule I drug, their trafficking an illegal narcotic, all these dispensaries, according to the federal government,” Humble said. “The IRS says ‘You’re trafficking, you can’t deduct your labor costs and business expenses because you’re trafficking in a narcotic that’s illegal.’ So if you move it to Schedule III, those dispensaries should be able to start deducting their business expenses like any other business.”