U.S. dollar weakens, off to worst start in more than half a century

July 8, 2025

This year, the U.S. dollar is off to its worst start in more than half a century. The currency has weakened more than 10% over the past six months when compared with a basket of currencies from the country’s major trading partners.

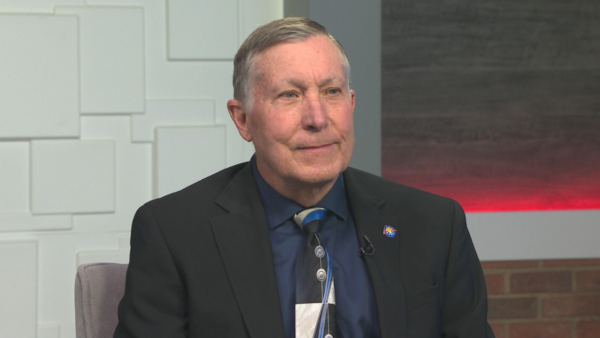

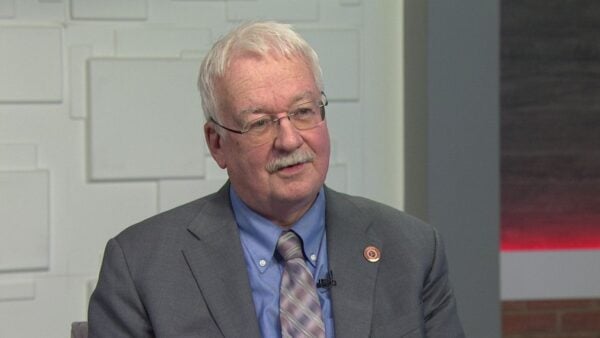

Joining “Arizona Horizon” to discuss the weakening dollar was Jose Jurado Vadillo, Ph.D., Research Economist at the Seidman Research Institute at ASU.

The last time the dollar weakened to this degree at the start of the year was 1973, after the U.S. had made a seismic shift that had ended the linking of the dollar to the price of gold.

This time the seismic event is President Donald Trump’s efforts to remake the world order with an aggressive tariff push and a more isolationist foreign policy.

Economists say the combination of President Trump’s trade proposals, inflation worries and rising government debt has weighed on the dollar, which has also been buffeted by slowly sliding confidence in the role of the U.S. at the center of the global financial system.

“So there’s been some estimates put up by people. The current range is that 10% depreciation of the dollar will lead to around 0.3 to 0.5% increase in inflation,” Vadillo said.

Vadillo shared his predictions for the second quarter and if he thinks things will turn around.

“There’s certainly room for market movement in either direction. However I think that some of the fundamentals that we’re seeing in terms of the size of the debts and the fiscal trajectory going forward are going to be much harder to move away from,” Vadillo said.