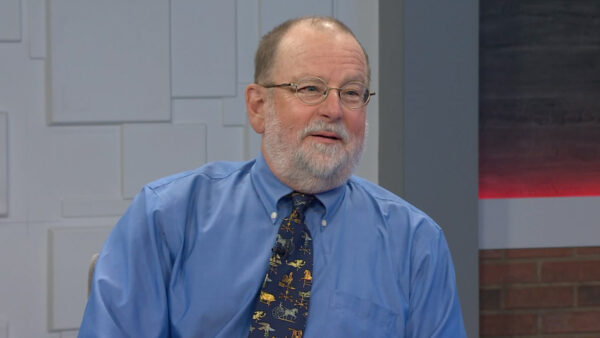

A measure heading for the November ballot would increase the sales tax to raise funds for transportation projects. The �T.I.M.E. Initiative� seeks to fund improvements to the state�s transportation system through a one-cent increase to our statewide sales tax over 30 years. David Martin with the T.I.M.E. Coalition talks about the measure. Martin is also president of the Arizona Chapter of Associated General Contractors.

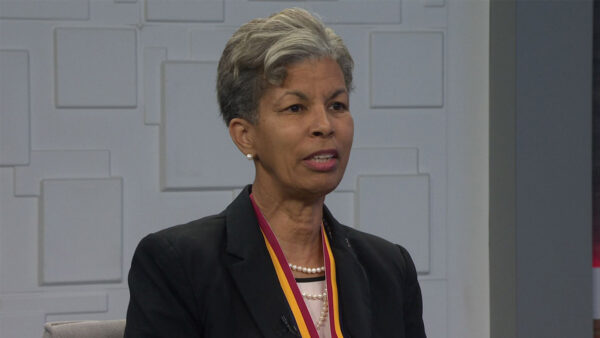

Ted Simons:

A group called Transportation and Infrastructure Moving Arizona's Economy or the T.I.M.E. Coalition, is working to place an initiative on the November ballot. The measure, known as the T.I.M.E. Initiative, seeks to fund improvements to the state's transportation system through a one-cent increase to our statewide sales tax over 30 years. Here to talk more about the initiative is David Martin with the T.I.M.E. Coalition. Martin is also president of the Arizona chapter of Associated General Contractors. David, good to have you on "Horizon."

David Martin:

Thank you very much for giving us the opportunity to talk about this extremely important subject.

Ted Simons:

You bet. Let's talk about just what exactly the T.I.M.E. Initiative is and what it does.

David Martin:

Well, a little bit of background real quick just so you know, we are a group of business leaders and business organizations in the state that felt that transportation and infrastructure were extremely important to our economy and our quality of life. We organized about a year, year and a half ago to encourage the legislature and policy makers to act on what we consider one of biggest issues that need to be addressed with our explosive growth.

Ted Simons:

General contractors, why are they supporting this?

David Martin:

Our organization obviously builds roads and streets and freeways. Obviously there's a public good that comes with our work.

Ted Simons:

Sales tax only. Why not combine other avenues of funding with a sales tax and lower that sales tax as opposed to going ahead and putting this one-cent thing through.

David Martin:

Well we contemplated that on a number of fronts. Let me answer that in two ways. First of all whenever you are running an initiative or for that matter a referendum you get into dual-subject issues. So we had to keep it as clean as possible to avoid the dual-subject issue. Secondarily, we did polling -- extensive polling -- with the voters about what type of a tax they would like to implement. And obviously the number one tax which appealed to a number of people were impact fees for example. So if you were to bring an impact fee of 1,000 per structure statewide that would bring $86 million. Not really enough to put a dent into a significant transportation plan. The next tax that was popular or actually a couple down was a statewide sales tax that was palatable to the constituents out there. That brought in $1.4 billion a year. From a critical mass process, we obviously felt that the sales tax was the better choice.

Ted Simons:

In other words, if the impact fees and developer fees and these kinds of things, the user fees in general, were combined with the sales tax, the thought was that's just too complicated?

David Martin:

Well it gets too complicated because you get into the dual subject issue of the constitution specifically states when you take an issue to the voters it has to be single subject. That's why we were very careful in crafting the initiative to make sure that it dealt just solely with transportation and a single revenue source.

Ted Simons:

I know that some mayors around town here in the Valley are not too pleased with this because it will raise taxes obviously in general, some of the cities -- residents of the cities paying up to 10% I imagine research has shown. They are also saying this kind of puts them behind the eight ball because when they want to raise taxes for something much more local they will not be able to do it now because the taxes are already up there.

David Martin:

That's a great question. First of all I would answer that two ways. It doesn't change the peridime as it relates to inner city competition. The disparity between city A and city B remains the same because it's across the board. The second piece of that that I think is extremely important for the voters to know is that 20% of this tax revenue goes to the cities and the counties specifically to be managed by them. So if they were contemplating, for example, a sales tax increase for transportation, no need, we're handling it here in 2008.

Ted Simons:

Right, yeah. I guess their concern is, if it's not for transportation, then they got to figure something else out. But I think you understand their concern.

David Martin:

Sure, definitely.

Ted Simons:

There are also concerns regarding the economy. Again, if we're not in a recession, it's certainly close and we're playing touch and go. Is there a concern that raising the tax, raising it this much, would hurt a fragile economy?

David Martin:

Actually to the contrary. But let me go into what I consider important information on the issue of the voters and how the voters feel. We asked the voters -- because we're not going to dump a lot of money into an initiative process where we're throwing money away where it's not plausible for this thing to pass. So we had to ask that question ourselves as a business organization whether or not we wanted to make this investment. And that question was asked to the voters. Do you want taxes or do you want to address the state's priorities? And on a 2-1 basis they said we need to address the state's priorities. We followed up with a question on the sales tax and that was in the majority also. The other component, dealing with the fragile economy, this tax doesn't go into effect until January 1 of 2010. And the beautiful thing about that is that ADOT and other communities that want to begin construction projects immediately after this passes, they can, because you can bond against that sales tax immediately as opposed to waiting until 2010. So we were cognizant of that.

Ted Simons:

The plan also seems to concentrates on upgrading transportation systems especially roads that are already in place as opposed to concentrating a lot on new roads. The thought behind that?

David Martin:

I don't know if that's the correct assumption. For example, we have in the plan the expectation to build the freeway system and widen the freeway system from Tucson all the way to Flagstaff. There are also a number of new corridors that are proposed in the plan. So I guess I'd challenge that premise.

Ted Simons:

Ok, so, the idea that there's some concern that it sounds like you're upgrading what's already there as opposed to piling on new freeways, you dispute that?

David Martin:

I dispute that, because there's also a huge portion in there for public-private partnerships that allow for connectivity from, let's say, Apache Junction down to the Tucson area and also on the other side of I-10.

Ted Simons:

Ok, accountability and performance evaluation for when the construction starts, provided it passes. Are those abilities to measure there?

David Martin:

Yes, and the initiative specifically spells out that the -- general would be responsible for that, the legislative branch. And that those who commence on 2015 and every five years thereafter. Furthermore it specifies in the initiative that the -- general shall hire folks that are very specific to a specific mode. For example, you don't want to have a transit expert deal with freeways and you don't want a freeway expert to be auditing obviously transit facilities. So it was very specific to lay that out.

Ted Simons:

The plan obviously shows a lot of specific projects from a trolley system in Tucson to widening, expanding freeways and such. How do you convince a relatively home body in Peoria that they should pay more taxes so that folks in Tucson get a trolley system?

David Martin:

Because we have here, and I can show you these if you'd like me to, some comprehensive fashion here that those projects that will also be beneficial to Peoria, as well as Tucson, as well as Flagstaff, etc. and every county in the state.

Ted Simons:

So, again, we're kind of going back to the user fee aspect of all this. The idea of folks paying a sales tax that some folks may use more than others. Best way? Most equitable way?

David Martin:

Most palatable way for the general public. We tested the gas tanks, as an example of what's on the bottom of the list. Obviously as gas prices are going up, that would be an obvious assumption that people would make. It's equitable because at the end of the day, right, you have to get your shirt delivered to you. You have to buy goods and services and the sales tax, we believe, was the most equitable way to do that.

Ted Simons:

Real quickly, how's the signature gathering going?

David Martin:

We're doing fantastic there. We are at 210,000 signatures; we need 153,000, so we're giving ourselves a really, really good cushion.

Ted Simons:

David, good stuff, thank you for joining us. We appreciate it.

David Martin:

Thank you very, very much for the time.

David Martin:T.I.M.E. Coalition and President, Arizona chapter of Associated General Contractors;