Impact of Silicon Valley Bank’s closure from Friday

March 13, 2023

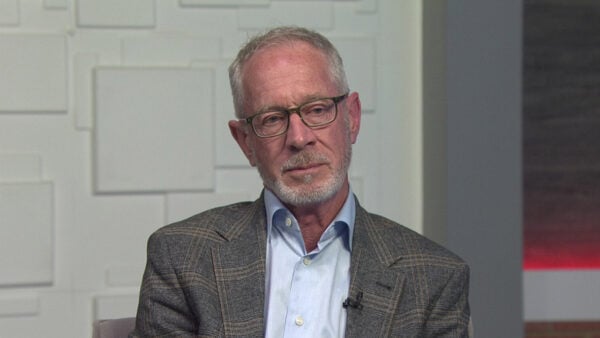

Silicon Valley Bank collapsed last week, marking the second biggest bank failure in U.S. history. This has caused fallout for mid-sized banks and many assurances from the government that the U.S. banking system is secure. Joining us to discuss the banks failure is ASU economist Dennis Hoffman.

“What happened here was an imbalance of assets and liabilities,” said Hoffman. “What the risk assessor said Silicon Valley didn’t do very well is anticipate how much the price of those securities was falling as a result of higher interest rates.”

As Hoffman points out, the bank did not have as much backing as it needed. This caused a problem for the institution when a significant number of its high depositors withdrew large sums.

“Financial institutions, like banks, they operate on a system of confidence and faith, the depositors have to have confidence and faith in the institution,” said Hoffman. “And that is why they leave their money in that institution.”

Silicon Valley Bank was founded in 1983 and has mostly served as a financial institution for tech companies and startups as well as many venture-backed companies like Air BnB, Roku, and Etsy. In 2021, the tech industry grew, and the bank bought many Treasury Bonds. When the government began raising interest rates, these bonds saw a decrease in value. This, combined with the Federal Reserve System raising borrowing rates, many of the bank’s customers began pulling out their money.

To raise cash to pay withdrawals by its depositors, Silicon Valley Bank announced it had sold over $21 billion worth of securities and borrowed $15 billion. It also announced it would hold an emergency sale of some of its treasury stock to raise an additional $2.25 billion. The announcement, coupled with warnings from prominent Silicon Valley investors, caused a bank run as customers withdrew funds totaling $42 billion by the following day. On Friday, the California Department of Financial Protection and Innovation seized the bank and put it under the receivership of the FDIC. The FDIC and President Biden assured all of those who had their money in the bank would receive it, despite the FDIC only insuring deposits up to 250K.