Chip manufacturers bring new platforms to Arizona

Nov. 18, 2025

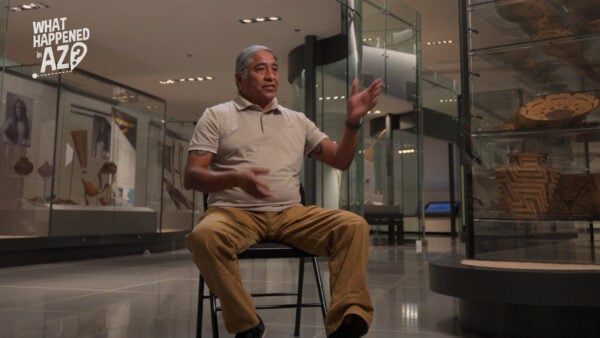

Arizona hasn’t often been thought of as a start-up hub. But, now tech investors, specifically, chip manufacturers are noticing. TSMC and AMKOR have set up shop bringing hundreds of jobs to the area. GPEC is also launching a new platform. Christine Mackay assumed the role of president and CEO on October 6th.

“We’ve always been this mecca for start-ups,” Mackay said on Arizona Horizon. “Where we see this move to a new level is the last decade, but really the last five years.”

Many of the region’s startups are homegrown, the product of decades of engineering and research talent from Motorola, Intel, Honeywell, Arizona State University, and the University of Arizona.

“So many are homegrown. They are engineers who came to work for Motorola or Intel or Honeywell. They are spinouts of university,” Mackay said.

The pandemic also pushed a new wave of entrepreneurs into the Valley.

“People wanted to relocate to Phoenix for a better lifestyle — and brought the start-ups with them,” she said.

For years, venture capital firms largely overlooked Arizona, investing remotely from coastal hubs and often relocating promising companies out of state. But Mackay said that pattern has changed.

“Now, with the density and number of start-ups we have, you’re seeing the family foundations and those venture capital offices come here because the companies they can invest in are reaching scale,” she said.

Arizona’s regulatory “sandbox” has also attracted attention. The model allows emerging companies to test technologies before they face the regulatory burdens of fully commercialized businesses.

“Our start-ups get to test their technologies without having to meet the rules and regulations that a commercialized business does,” Mackay explained.

Startups in the region are launching across a broad set of sectors, from life sciences to aerospace.

In bioscience and medical technology, Mackay said companies are innovating in areas like implantable devices, wearables and cancer therapies. Advanced air mobility—such as delivery drones and autonomous systems—continues to expand, as does defense innovation.

Still, semiconductor manufacturing remains the anchor.

“It is absolutely the lead, especially now with Intel or TSMC here,” she said.

Mackay emphasized that Greater Phoenix’s collaborative environment is one of the region’s defining advantages.

“This is an economy built on collaboration,” she said. “They don’t have silos and fight with each other.”

She said accelerators can call on larger firms for help with technical problems and receive immediate support.

“You get a half-dozen engineers from the big primes who help solve the problem that night,” she said.

As artificial intelligence becomes central to global industry, Arizona’s semiconductor capacity gives the state an edge.

“Artificial intelligence is moving into all facets of life, and Arizona is at the center of that with our chip manufacturing,” Mackay said.

But she warned that the growth comes with significant infrastructure demands, especially power.

“Water isn’t the thing that would concern me the most as much as power,” she said. “When you’re dealing with massive amounts of heat and that technology, the water and power is something you have to overcome.”

Utility providers and policymakers are already working on solutions, she added.

Mackay said GPEC is engaging with companies at every level—from early-stage startups to global manufacturers.

“We work on small enterprises to the big technology companies… helping them find the connections, technologies or advantages they need to scale and stay here,” she said.

Mackay said the next phase of innovation is already on the horizon.

“The next thing I would watch for is human-carry drones,” she said. “In the next five years you will see people using drone taxis, like Waymo did with autonomous vehicles.”

As major chipmakers invest billions in Arizona and homegrown companies continue to scale, the state’s emerging identity as a startup hub appears increasingly solid.