Rising costs and lower spending hit Arizona’s sales tax revenue

Nov. 6, 2025

Ninety percent of Arizonans are spending less as the costs of goods and services rise according to economists. A majority of the state’s general fund is financed by sales taxes, meaning that if people are spending less money, the state government will not have their anticipated budget to support state funded programs.

The committee also says tariffs created by the Trump administration has led to higher costs and decreased spending. The issue of decreased spending will only be made worse if Arizona alters its tax code to fit the tax cuts from the One Big, Beautiful Bill Act.

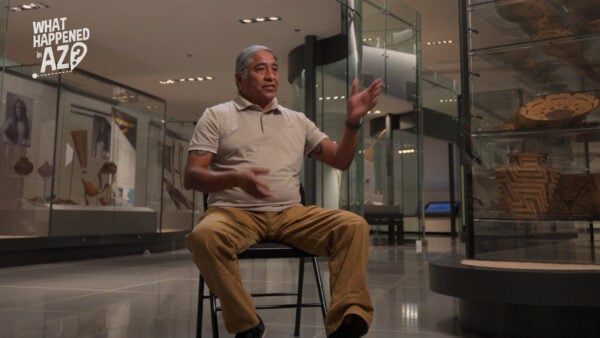

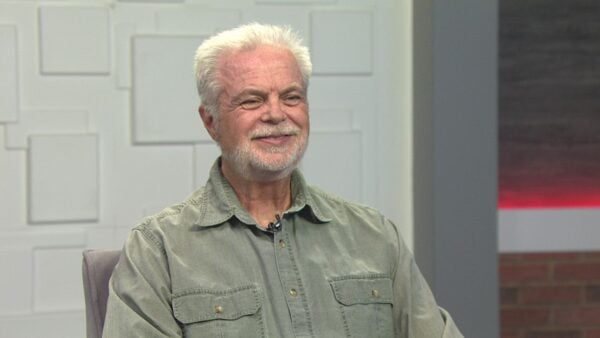

ASU W.P. Carey School of Business Professor, Dale Rogers, joined “Arizona Horizon” to talk more about how the decrease in consumer spending could impact state funded programs.

According to Rogers, the economic grief is heavily hitting the lower end of the economy, and says the Trump administration is “on the side of the rich guys.” It is also showing to be a difficult economy for those just coming into the workforce.

“We’re seeing some new college graduates even have difficulty getting a job because of the uncertainty in the economy right now,” Rogers said. “Also, the investment in AI… people think they need less people because of the investment in AI.”

A combination of people struggling with employment, no access to SNAP benefits and more, Arizonans are spending less money, meaning less tax revenue for the state. Arizona will have to rely on other funds to pay for the programs that are government funded.

According to Rogers, the state has a strong rainy day fund, but he expects all of that money to disappear this year.

“I think it’s going to be some really difficult decisions at the state level,” Rogers said. “We’re clearly seeing some signs that could signal a slow down in the economy.”