Experts say Medicare premiums could wipe out Social Security increase

Nov. 25, 2025

Millions of Americans will see a 2.8% increase in their Social Security benefits in 2026, an adjustment that adds about $56 a month for the average retiree.

But financial analysts warn that the boost may not keep pace with soaring expenses, especially in healthcare, housing, and other essentials that make up a large portion of retiree budgets.

Many older adults are reporting monthly Medicare premiums rising far faster than their annual COLA adjustments, meaning they effectively fall behind despite the increase.

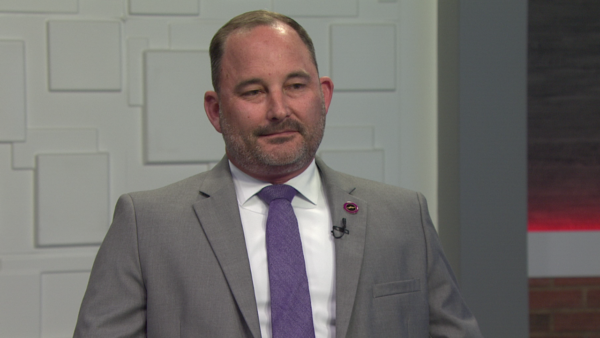

Jay Spector, the Co-CEO and founding partner of EverVest, joined “Arizona Horizon” to break down what this year’s adjustment really means, how cost pressures vary depending on where retirees live, and why many households are still struggling to keep up.

Spector noted that while 2.8% is slightly higher than last year’s cost-of-living adjustment, “2.5, 2.6 last year,” he said.

It pales in comparison to the spikes retirees saw during and immediately after the pandemic, when COLA increases ran “north of 5%” and even hit “8.3%” in one year.

Those higher bumps, he explained, were driven by inflation data from the third quarter, which the Social Security Administration uses to set future increases.

For the typical retiree, the 2026 increase translates to “between 50 to $60 a month,” Spector said, but that modest gain is often swallowed up before it even hits a checking account.

“You have to think Medicare increases are more than that,” he added. “Most retirees are not going to see a substantial increase to their Social Security.”

Social Security’s COLA “is really not meant to provide a huge increase,” he said, but simply to help offset rising costs, a task made harder when “most retirees’ cost of living is much higher than what kind of the average American’s cost of living is.

Spector warned that the categories retirees rely on most are seeing some of the steepest price hikes.

“You’ve got rising inflation in food, in medical services, prescriptions and so forth, and that’s going to completely erode what those retirees are going to experience this year coming up,” he said. While everyone feels inflation, retirees are especially vulnerable because “retirees run on fixed income.”

With that in mind, Spector urged retirees to use the current Medicare open enrollment period to try to claw back some savings.

“They have an opportunity to shop supplemental plans to see if they can reduce the cost of their medical coverage,” he said.

That requires being “keen shoppers and keenly aware of what their expenses are” and looking closely at where they might trim costs if their income is no longer stretching as far as it once did. Too many people, he added, have a “set it and forget it attitude” about Medicare and other recurring bills, when revisiting those choices could free up badly needed cash.

Longer term, Spector said he does not believe Social Security is on the verge of disappearing, but he does see difficult choices ahead if Congress fails to act.

“I don’t really see that Social Security is going to go bankrupt,” he said, noting that “about 75 to 80% of paycheck payroll taxes covers Social Security benefits.”

Still, without changes by the mid-2030s, lawmakers may have to consider options like raising the full retirement age, reducing future benefits, increasing the payroll tax rate, or lifting the cap on income subject to Social Security tax.

For both current and future retirees, Spector returned to one central piece of advice: know your numbers. “Biggest thing for retirees is get a handle on where [their] budget is,” he said.

Once people understand “what income is coming in and going out on a monthly basis,” they can make better decisions about spending cuts, insurance choices and how to use their savings.

It’s the same question he hears over and over from people nearing retirement: “We’re spending X amount of dollars each month, how do I convert my portfolio into an income-generating portfolio to live the way we’re living?”