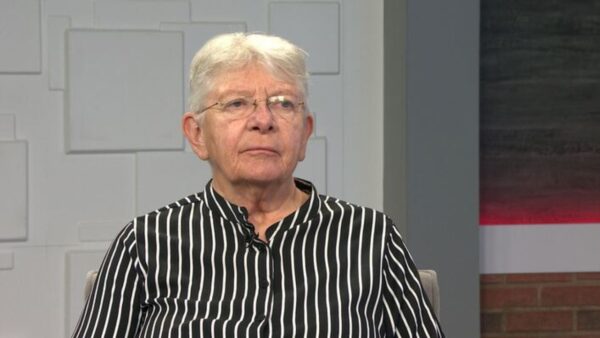

The Internal Revenue Service is facing scrutiny for allegedly targeting conservative groups for audits. Also, Apple Inc. is being criticized for moving profits off shore in an alleged effort to avoid U.S. taxes. Adam Chodorow, Arizona State University Tax Professor and Associate Dean for Innovative Ventures, will talk about both issues.

Ted Simons: Apple, the High-tech giant being criticized as one of the hyper-profiled U.S. companies moving profits off-shore in an alleged effort to avoid U.S. taxes. Here to talk about the issue of profit shifting is Adam Chodorow, he's a tax professor at ASU and associate Dean for innovative ventures at the O'Connor college of law. Good to have you here and thanks for joining us.

Adam Chodorow: Thank you for having me.

Ted Simons: What is this controversy involving apple and taxes?

Adam Chodorow: Well, what apple has managed to do is to shift its profits overseas, and in a way that actually allows it to avoid paying taxes on a huge portion of the income.

Ted Simons: And apple testified, in an executive that, I think the new Steve Jobs did this or someone close to him, they six paid billion of taxes last year at a 30% rate. Valid?

Adam Chodorow: Not really. So the U.S. has what we call a territorial tax system, or rather, a worldwide tax system where the ideas we're going to tax you on income wherever you earn it. And but, we also have, have this, this deferral system. Where if you earn the income overseas, you don't have to pay tax on it, and until you take the money back to the United States. And, and so, what apple and a number of companies have done, is that, that they have figured out a very clever way to shift income and have it appear to be earned overseas, subject to deferral, and not subject to any U.S. tax.

Ted Simons: Now, subject to a deferral, meaning eventually that's got to come back home, doesn't it?

Adam Chodorow: If they bring the money back home.

Ted Simons: Yes.

Adam Chodorow: But, what happened, I can't remember how many years ago now, about five years ago, is that they convinced Congress to have a tax holiday. Where they were allowed to bring home hundreds of billions at a very low, a 5% tax rate. And so, since then, companies like apple have, have stockpiled something in the hundreds of billions of dollars again in the last five years, and now, they are saying hey, this money is trapped, we would love to bring it home and fix the economy and help hire people but we cannot because of the tax rates so could you give us a tax holiday again?

Ted Simons: They are just waiting on the holiday, and apparently, apple now with this worldwide taxes, only 14%, as opposed to the 30%, something along those lines?

Correct, and what apple has done is more clever than many others. The idea is that you want to shift profits to a country with low taxes. So, let's say that you make an apple phone and it cost you $10 to make, and you sell it for $100, that's a $90 profit. If you do that here, you pay tax on the profit. And but what if you, you, apple, make it through a subsidiary, and say, a low tax country and, and it cost you $ to make but you charge apple U.S. $98 for the phone. So now you have got all this profit occurring in this low tax country. And when apple sells it in the U.S. it reports $2 of profit. So, but apple has taken that further. Because they figured out way to, to, to say, basically, look, the company that is making this profit, it's subject to deferral in the U.S., no U.S. tax, but, they went to Ireland and set it up in a way where the Irish say, well, actually, it's not subject to Irish tax, either.

Ted Simons: Right.

Adam Chodorow: So it's not that they are paying low taxes, on, on this to another country, they are paying no taxes on a lot of the income that they earn.

Ted Simons: How common is this?

Adam Chodorow: It's getting more common because once one person figures out how to do this, there are a lot of copycats, and so what you'll find is that the CFOs of the multi-national companies, have come to understand that tax management is, is, is, you know, sort of a big part of their job. And they are constant looking for ways to reduce their taxes.

Ted Simons: What are these other -- the Irelands of the world, what are these other countries saying about this? Are they willing partners? Are they tired of it? What's happening?

Adam Chodorow: A number of them are willing partners. Because what they get, it depends on the structure, so, sometimes, what they are getting is U.S. moving manufacturing over to their country. So, say, you know, it's basic tax competition. If you build it in the U.S. you will pay a ton of taxes, if you build it in Ireland, you will pay less. And well, what does what does that mean? That Ireland gets a business, which employs people, and so, if those cases, Ireland has everything to lose. The latest ploy that we're talking about here, where neither the U.S. nor Ireland taxes it, I don't think either of the countries really want that. That, that's a crack in the system that, that apple has found and is exploiting. But Ireland doesn't really gain because that's just a paper gain being played.

Ted Simons: What are some of the other countries involved? Both in profit and expense shifting?

Adam Chodorow: Well, the people use the Netherlands, and there is, obviously, the Cayman islands and tax havens, oddly enough, in warm sandy places. And, and that people tend to go, and, but there are a bunch of countries, a lot of the banks secrecy laws in Europe allow people to, you know, to create bank accounts that people don't know about and, and do all kinds of interesting tax planning.

Ted Simons: How is this all playing on Capitol Hill? Are we going to see the changes afloat here?

Adam Chodorow: You know, it's hard to say. On the one hand, when something like this happens I have hope, I think, oh, finally they are going to fix it. But, one of the solutions being ban tested about the problem is, we're trying to tax people on the worldwide income and we should be territorial, only tax it on, in the U.S. and income earned elsewhere be taxed elsewhere. And that would exacerbate the problems. Because they are going to be more and more these cracks in the system that people will find. And, and there is a lot of talk now about lowering the corporate tax rate. And because the idea is this is happening because our tax rate is so high, and our corporate tax rate is high. The nominal rate is high but the effective rate, is far less. Because, because there is so many ways to game the system, and shift either income overseas or take expenses from elsewhere and apply them against the U.S. income.

Ted Simons: Last question, quickly here, country-by-country reporting so everyone can see what's going on and where it's happening. Is that possibly on the horizon?

Adam Chodorow: It may be. We're making steps now. We're, we're trying to get information reporting automated and, and, and built up. But, it's really hard to get into the financials here.

Ted Simons: All right. Good information, and good to have here. Thanks for joining us. We appreciate it.

Adam Chodorow: My pleasure.

Adam Chodorow:Tax Professor and Associate Dean for Innovative Ventures, ASU;