What the end of the year financial update means for 2021 and 2022

Oct. 28, 2021

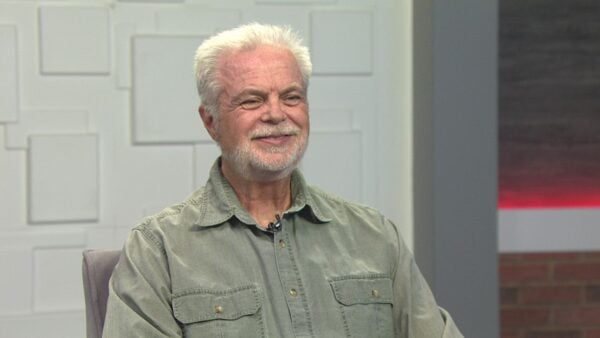

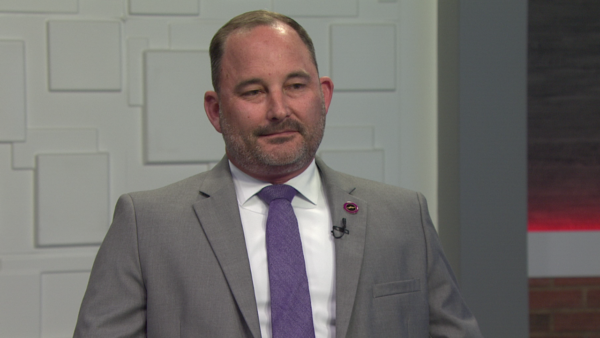

As 2021 slowly comes to an end, we talked about the latest end of the year financial update. Jay Spector Partner & Advisor at Barton and Spector Wealth joined us to discuss everything from COVID-19 to technology and investing.

“This year has taken a turn for the better,” Spector said when talking about the market. But with that has come higher inflation on goods and services we use everyday, he added. “There are positives and negatives.”

Spector mentioned that inflation is something people have to watch out for in the coming months and years. “You have people worrying about a plethora of jobs here in the Valley.”

Investors need to be cognizant of their investor plans, he added. “If investors are going to retire in the next few years, they need to figure out how they’re going to maintain or enhance the lifestyle they currently have.”

There is a 60:40 model. Sixty-percent stocks and 40 percent bonds. “You have to really focus on your end goals and how you’re going to maintain those end goals.”

When mentioning college planning, Spector said that Arizona is is one of seven or eight states in the nation that allows people to contribute to any 529 college savings, which is a college savings plan. “They deduct their contributions up to the stated limits from the state income taxes.”