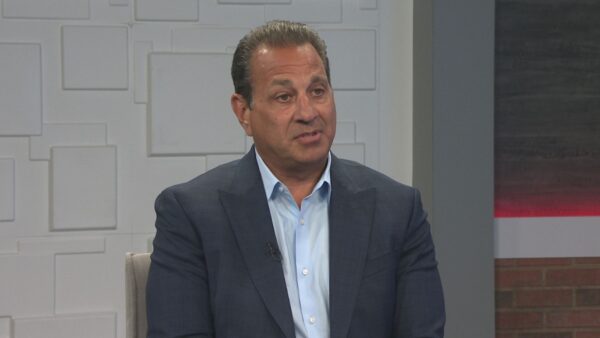

Arizona is already feeling the effects of the government shutdown. The Grand Canyon National Park is closed, and civilian workers have been furloughed at Luke Air Force Base. Arizona State University economist Dennis Hoffman and economist Jim Rounds of Elliott D. Pollack and Company will discuss the impacts of the shutdown on Arizona.

Ted Simons: The Grand Canyon National Park is closed, and civilian workers have been furloughed at Luke Air Force Base. Those are just some of the indications that the federal government shutdown is being felt in Arizona. For more, we welcome ASU economist Dennis Hoffman, and economist Jim Rounds of the Elliott D. Pollack and Company. Good to see you both here. Thank you for joining us. All right. Dennis, we see a little bit here, a little bit there. How is this shut down going to impact Arizona?

Dennis Hoffman: Well, you know, probably in terms of job loss, the bigger impact is obviously D.C., because most of these folks work in D.C. But a lot of these agencies have staff distributed across the country. So, you're dealing with significant numbers of agency reductions. And they're going to affect all of the states. And the thing that is harder to kind of get after is what type of private sector job loss will there be? Around the Grand Canyon, think about the hotels, restaurants, transportation services, almost all of which are private sector related. What is going to happen to employment in those kind of places? So, this is a big deal. I understand some folks thinking that it is just a D.C. issue, and it is just Congress having a little tiff, but 800,000 jobs, the equivalent of 800,000 jobs. Takes this economy about five months to generate 800,000 jobs and we got rid of them in one day.

Ted Simons: Is this a big deal?

Jim Rounds: Yeah, I think it depends on how long it lasts. So, if we're dealing with a week, I'm not worried about it at all. I wouldn't change the forecast. We're dealing with 40 out of 2,080 hours in the year for an average person. If it is something that lasts two, three, four weeks, the last time we went through this it lasted 21 days, and then it becomes a bigger deal. It also becomes a bigger deal because we get into the next policy issue, the debt ceiling. Things potentially could really spiral out of control. But if they solve it this week, I will not be nearly as concerned.

Ted Simons: The last government shutdown was 1995, we had 20 some odd days there. What kind of damage was done to the economy after that?

Jim Rounds: Stronger economy. We have been in recovery mode for quite a while. But it is kind of like that it is not the age of the cars, it's the miles. We haven't gotten that far in terms of the economic recovery. The economy is still pretty weak, but the size of the economy is quite large. The worst estimate I saw is if this lasts three, four weeks, it's a $55 billion hit. And it was going to lop about half of the GDP growth in the fourth quarter. I think that study might be overstated some. But it gets back to the duration issue. If it lasts long, if we can solve it this week, it is not a big deal. If it gets beyond that, we could have some problems.

Dennis Hoffman: Mid 90's, consumer confidence was north of 100. We're like 30 points below that right now. As Jim said very accurately, we're in recovery mode, and I think it would be legitimate to worry that with an economy that is actually positioned, if you just look at consumption, which has been the real challenge over the last five to six years. Auto sales, consumer durables, everything seems to be progressing quite nicely. Employment growth is not. It is disappointing. But the consumer is warming. And it is warming month after month, and the consumption data look pretty good. Housing has warmed. So, the question would be is this going to be a shock to confidence? The old CNN effect. This buzz around a government shutdown and all of the concern about these kinds of job losses, is that going to make people hesitate?

Jim Rounds: Boy, that hasn't been discussed enough, I think, consumer confidence. Just confidence in the government in general, and I think everybody would have been surprised if the federal government actually worked through this in a -- in a mature manner. I think the new normal is that expect some disruptions. In fact, many economists' forecasts assume that some goofy stuff is going to happen in Washington. But it's difficult to know if we're going to have a lasting impact and are we going to have this cumulative effect over time because people really don't have faith in Washington. The people that have been furloughed, they're on a week off of work right now. If it becomes three or four weeks, it is almost like a layoff. They're going to change their habits. The psyche of the American consumer will change a bit and we might regress some and that would be really disappointing.

Ted Simons: If the economy is more fragile, let's say than it was in 1995 and this goes the same amount of days as 1995, will whatever damage is done, will that recovery take longer than it did in 1995?

Jim Rounds: It's hard to tell. We were right at the point where we were starting to see more solid economic data. I don't buy that we're going to lose 1.3 percent off of the expected rate of growth of around two and a half for the fourth quarter if it went on for three or four weeks, but it is possible. That's a problem. Now, if this is temporary, and these aren't really lost jobs, it's just people not getting paid. We have that shock to the economy one year but then we're not losing the jobs going forward. It is a different situation than a permanent job loss. So the analysis is different than say the sequester, when we knew that we were going to be permanently losing a lot of jobs.

Ted Simons: Talk about the sequester, how does this impact - I mean we've already got the sequester - it's still happening.

Dennis Hoffman: Well, yes, that is the irony, I think, Ted. A clean continuing resolution passed out of Congress right now as I understand it, the ones on the table, would contain a continuation of sequester. So, if I'm a proponent, I am using hypothetical, if I were advancing streamlining government, you know, there is some victory to celebrate here. But evidently, it is not enough victory, and so, therefore, we have log jam.

Ted Simons: We have got this elephant in the room, this government shutdown, yet over in the corner, Godzilla --

Dennis Hoffman: We have a few elephants in the room.

Ted Simons: Well we have Godzilla in the corner with the debt ceiling. Talk about what happens if this debate moves into the debt ceiling debate, and that sounds like real trouble.

Jim Rounds: Well, the government shutdown is more of a bummer. If we can get this resolved within a couple of weeks, hopefully this week. It is disappointing for a lot of people, a lot of specific individuals it is extremely disappointing. But for the economy as a whole it is not as big of a deal. If we get to a point where we don't adequately address the debt ceiling, that is something brand new that we have not ever done before where we haven't been able to take care of our other financial obligations. This would be all new territory for the U.S. and that could be something that could really cause disruptions. That is the type of thing where people do change their economic forecast.

Dennis Hoffman: Indeed. Flashing back to Lehman, the take-away from Lehman Weekend for me was when I heard that we came very close to defaulting on commercial paper. What does that mean? That means that most business, many businesses wouldn't have been able to meet payroll. So, all of the sudden we go from, you know, being concerned about the economy to not having a check on the next Friday. That was Lehman. If we flirt with this, and actually go down this road, and I -- and I still have my doubts just simply because, you know, people at some point have to wake up and recognize the severity of this. But if we would choose to go down this road, really play hard ball into a debt ceiling debate, it is going to be worse than Lehman. So then we've got to go back and revisit is the fall of 2013 going to be anywhere close to the fall of 2008. Goodness, I hope not.

Ted Simons: We know how long it's taken to recover from the fall of 2008. How close do you tip-toe to this particular issue and not do damage? Because it would seem like the psychological damage of even saying it's a possibility is out there?

Jim Rounds: So with the shutdown longer term, it really is just for show right now. The fact that they would fence off some of these national monuments, where it's just a field and a stone statue or something like that, it's all show. I actually couldn't get on to some government web sites today trying to update economic data. That's just ridiculous. That is for show. But with --

Dennis Hoffman: It's more than show, if there is nobody there, you have security attacks you have to worry about. If there's not folks there monitoring those web sites, they have got potential issues. So, yeah, we have - the Census is done, the BLS is down, we have no labor data on Friday.

Jim Rounds: I don't mean the economic issue is a show. I mean the political garbage going on is mainly a show. The discussion they're having right now and the debate, they really shouldn't be having right now. I was referring to more that being a show.

Dennis Hoffman: Fair enough.

Jim Rounds: The debt ceiling is more I think a pure economic issue. They will bring in some of the tea party comments, how we can't keep having our government expenditures greatly exceed revenues, but that is not a short-term resolution. That is something that has to be dealt with over the longer term. If politics turn and somebody wants to suddenly try to take care of this differential over a month or two, it is going to be a disaster. Some people need to pull back their expectations a bit.

Dennis Hoffman: Exactly right. We have very long-term problems and very serious ones. Sadly I haven't heard those discussed much at all from either side. And that is dealing with the long-term legacy obligations around things like Medicare.

Ted Simons: What does all of this say to the world's investors? With the shutdown and Goddzilla over there in the corner? I mean, do the world investors, do they have anywhere else to go? I've heard who cares what the world -- this is America, they will be here come what may. Is that a little out there?

Dennis Hoffman: It just sends another signal that, you know, the U.S., they question whether or not the U.S. has their act together. You know, we pointed our fingers and laughed about Greece and southern Europe for a number of years. I mean, it is very possible that a lot of folks around this planet are finding some humor in our dysfunction.

Ted Simons: Finding some humor, but will they do anything with their money? Will they do anything about their investments? Will this cause them to cause, delay, slow --

Jim Rounds: Not right now. If it is not extended -- we're sending a bad signal. Actually we're sending a perfectly accurate signal. We can't get our act together in D.C. That is what we have been sending for the last few years. You even saw with the stock market, the first day of government shutdown, the Dow closed higher than on the prior day. I think that most people are expecting this is going to be resolved short-term. If this goes on for a longer period of time, then we bring in that debt ceiling issue and then you might start to see investors pull back. You might start to see people feeling less confident purchasing bonds and then all of the sudden we're paying more. I mean, you can do an hour show just on the ripple effect.

Dennis Hoffman: The debt ceiling is the big deal and it's serious. It really -- historically -- folks debated in Congress, but they didn't hold hostage programs around this debt ceiling issue. At least not anywhere near like they have in this Congress.

Ted Simons: We should mention that tomorrow night we will discuss the political ramifications of what's going on. The fall-outs there-in. We wanted to hear about the economic aspects. Good to have you both on. Thank you for joining us.

Dennis Hoffman:Economist, Arizona State University;Jim Rounds:Economist, Elliott D. Pollack and Company;